There’s nothing new in what I am about to write. Countless people have written about this in past. In fact, you can find 100s of such posts in the archives of Moneylife. Somebody sent this tweet to me the other day. This person seems to have invested in 3 scammy stocks which were your run of the mill, classic pump and dump scams.

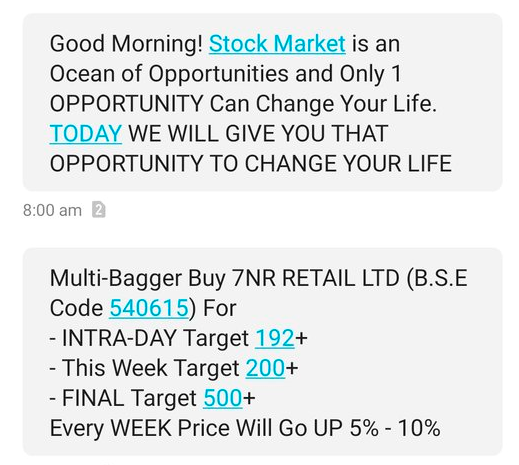

This is another really sad story of people investing based on random stock tips and losing their hard-earned money. Shockingly, in this case, this person has invested a Rs 1 crore in three stocks. The stocks in question are Agrophos, Mauriya Udyog, and 7NR Retail. Sometime around September 2019, these stocks were being pumped up by sending out bulk SMS. There was also a website called midcapgains.in set up to lure people in. Messages for another stock Darjeeling Ropeway were sent during the same period.

Agrophos was once an SME stock before it graduated to the mainboard. It all seemed well until it wasn’t. The stock IPO’d, graduated to the main-board, the price was rising, and then it all came crashing down, like a house of cards.

Here’s an old clip of one of the popular analysts talking it up:

Even in October 2019, a couple of months before the stock was about to go to the dogs:

I have nothing against these analysts. But I have no clue why people follow these analysts. Sure, people make mistakes. But when your words have the ability to impact someone’s life savings, you need to exercise restraint rather than handing out free advice. If this guy had held on to the stock based on this piece of advice, it would be below the price mentioned in the tweet without a chance to exit, given that the stock is hitting lower circuits. Of course, people have to do their own research before picking stocks and they are equally responsible. But that doesn’t take away the fact these public personalities have an immense responsibility when what they say can influence people’s trading or investing decisions.

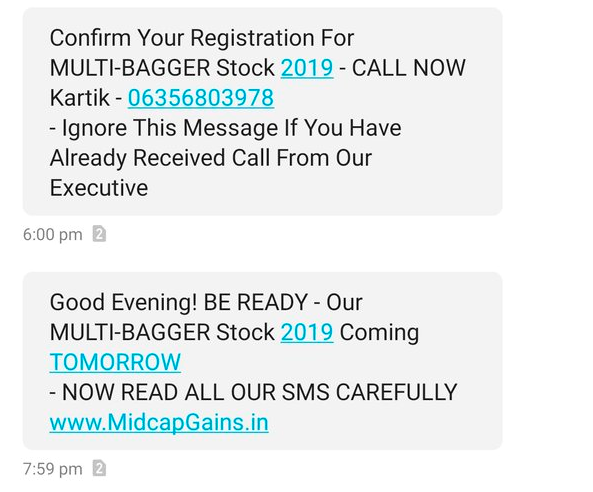

These messages were sent out in bulk. To mislead people, these messages were also sent out in the names of brokers. The way it worked is that people would get a call or would be asked to call these numbers and these scammy buggers were asking all these gullible people in invest in these 3 stocks.

Predictably, this hasn’t ended well. In the last month, these 4 stocks have fallen between 50% to 70%. Plenty of people had pointed out that these were absolute scammy stocks. Prashant had written a post around the same time.

But an SMS like this + gullible investors = disaster.

I was searching through Twitter and there have plenty of instances where people have invested lakhs of their savings in these stocks. As sad as this is, this money is gone. It’s very easy for me to write a post saying, people who invested in these stocks are dumb and that they should’ve used commonsense. But there will always be unwitting investors. Unfortunately, the lure of quick gains is hard for some to resist.

Like I pointed out at the beginning of the post, this isn’t the first time this has happened. There have been plenty of pump and dump scams where people have lost money. Here are some old favourites. All these stocks were manipulated the same way – with SMS and Telegram messages.

I am not going to rant about SEBI, investor protection and all that. There are more qualified people doing that. And no amount of regulations can shut these things down, there will always be scams as long as human greed exists, that’s the sad reality.

But I am writing this post hoping that serves as a deterrent to at least some people who would otherwise act bases on these SMS tips.

People, there aren’t any easy ways to get rich quick, at least legal ones. Please stay away from acting on tips, advice from random people, following gurus on twitter and outside. All these things won’t end well. Coincidentally, came across this Tweet. Tulsian is one of the more widely followed analysts. Here’s how the “Patakas” have fared:

Well, if you had invested in these stocks and held them, the Patakas would have blown up your portfolio. For comparison, here are the worst-performing mutual funds in the past 3 years: JM Large-cap Fund, Taurus Starshare Multi-cap Fund, SBI Magnum Mid-cap fund, Nippon India Tax Saver Fund, and Sundaram Small Cap Fund. None of the funds would have lost you money. Sundaram Small-cap Fund would have been your worst investment with a return of 1.75%.

Of course, this is a foolish example but I used to make a point. Direct equity investing is hard, unless you are a skilled stockpicker. It’s even harder when you are investing based on tips and other people’s recommendations. If you are starting out, you are better of picking the worst mutual fund than trying to pick the best performing stock. Of course, you might get lucky and pick the next hot stock but probabilistically, it’s not going to end well for you. The decks are stacked heavily against you.

Anish had an amazing thread called “bad things happen below 200 DMA“. It gives you an idea of just how difficult it is to pick stocks. If you have grandiose dreams of picking the next micro-cap from a list of penny stocks and becoming rich overnight, I hate to break it to you – you’re being an idiot.

As harsh as it is, the money you’ve invested in these stocks is gone! There’s nothing you can do. All you can do is think of this as a very costly lesson.

Further reading

Stock Manipulation Is Rampant & Unchecked: Here’s Why – Moneylife

Suckered: The Fraud SMS Pump and Dump Scheme – Capitalmind

The dark underbelly of the Indian Stock Market – Finception

Amazingly written. Please keep coming.

Well written and please keep them coming.