Gentlewomen and men, I’ve been around here for a long time and I’ve been around the block a few times. I was there when the first barter trade took place, a porcupine was exchanged for two goats and 1.2 meters of satin loincloth.

When people were freaking about this Corona crash, I was laughing my butt off. I’ve traded far worse market phases. Compared to the markets during the black death, this corona crash was but a baby’s fart.

I was there when the first stock exchange opened. I was there for the first pump and dump, I was also there when idiots pumped and dumped tulips, the 17th century IPO bubble. I was there when Isaac Newton was making those stupid trades and told him not to, I was also there when those currency trades John Maynard Keynes made went tits up.

I recently wrote this post about how the Franklin saga turned out, what’s happening, and most importantly who’s to blame. We investors, we love our free stock tips and blaming other people for our mistakes. But anyway, I had mentioned that I’d write about advisors, are they blameless here? Did they screw the proverbial pooch or did they not? But before I get to that, the topic of advisers reminds of a prescient and foreboding speech that my friend Abe Lincoln, with the beautiful beard and shawl, had made sarcastically on Tik-Tok. Goddamn Abe, was he right or what?

Four score and seven years ago our fathers brought forth on this continent, a new nation, conceived in Liberty, and dedicated to the proposition that all investors will be scammed equally. That we here highly resolve that these dead shall not have died in vain — that this nation, under God, shall have a new birth of freedom — and that advisors of the investors, by the investors, for the investors, shall not perish from the earth shall scam all investors equally without prejudice into ULIPs, endowment policies, Emu eggs, and credit risk funds equally.

A lot of hot takes are written in the aftermath of a disaster, 99% of it just surface-level, non-critical bullshit. The same has been the case with the Franklin episode. Everybody and rightfully so have blamed the AMC and Trustees

But once the smoldering flames of wreckage subside, you see a lot of evidence and then you can blame a whole bunch of new people for the disaster. In this whole fiasco, what has been astounding to me is how little blame advisors have received. They’ve pretty much gotten away with the crime. Mind you, this is no small crime, it’s 30,000 cr epic heist.

Ok, heist is an incorrect word. Ok, no money was stolen. Ok, no money was lost…yet. Ok, I shouldn’t have used heist, but you need some dramatic shit in an article! So bugger off!

But how could these so-called advisors even put money in Franklin funds and chase returns? In my head here’s how this conversation would have gone between an investor and an advisor.

Advisor: Hi, thank you for calling We’ll Make You Goddamn Filthy Rich Advisors, my name is Mr. I Make You Filthy Rich? You want to be rich?

Investor: Yes, yes, I have money, I thinking of buying Emu Farm in Tamil Nadu and put remaining money in Govt bonds? I advice want? Is I’s plan okay?

Advisor: I sorry, but I have to be honest. I can with you?

Investor: But what I do wrong?

Advisor: Emu egg scam, you get Emu shit in end. I help you, call me when you is serious, I hang up now.

Investor: Wait, wait, thou shan’t hang up! I meet you. When I come?

Advisor: Tomorrow

Investor: Go’s & meet advisor, throw money and table and shows and show picture to advisor – I want to be like this 👇

Advisor: Good, good. Now I put your 60% money in Double deluxe, triple premier Padmini super advantage equity fund, and 40% in Franklin India Dynamic Accrual Fund and Franklin India Income Opportunities Fund. These funds awesome, they dynamic and they have opportunities. You gonna filthy rich soon.

Investor: Super happy with high returns.

Advisor: Call investor at 9 PM and I super good news for you.

Investor: I win Thai massage package?

Advisor: No dummy, that 40% of money in Franklin funds is now locked! The company is shutting down funds.

Investor: How that good news?

Advisor: Investors big problem is take out money early. You now cannot, you learn the benefit of patience.

Investor: 👇

The investor was in China, so he speak China English, that not racist!

Ok, I was trying to make some poor jokes, but this is how it typically goes and I am not even kidding. Now, let’s grapple with the advisory ecosystem in India.

All the advice in the world

One of the biggest downsides of trading, investing, or even working in finance is those annoying calls from relatives. I’m pretty sure, you’d have received calls from relatives asking for stock tips because someone told them that you invest. Now, if you have half a gram of common sense you’d have recommended Suzlon, Vakrangee, PC Jeweller, and other such profitable bluechip companies 😂😂😂. I’m kidding, you’d probably have told them to contact a financial advisor instead of giving some half-arsed advice and buggering all their money.

But have you ever wondered if there are enough advisors? Before we even get to the numbers, the term financial advisor has become bastardized and almost become meaningless. Today, any jackass who watches CNBC and reads a shitty Moneycontrol article and tweets stock tips can call himself an advisor. The biggest scamsters in the whole of financial services – bank relationship managers and LIC agents who are notorious for selling toxic financial products call themselves financial advisors. Somewhere between the words in the last sentence, irony got up from it’s chair, walked in front speeding truck and killed itself!

I had written about this in another blogpost and cited a research paper which tried to quantify the damage:

A research paper by Renuka Sane and Monica Halan on mis-selling in banks tried to quantify the damage. Here’s a startling number:

Halan, Sane, and Thomas (2014) show that investors lost upto US $28 billion (Rs 1,96,000 crores) to mis-selling of unit linked insurance products between 2005 and 2012. Similarly, Anagol and Kim (2012) estimate losses of US $350 million from shrouding of fees by Indian mutual funds. A fall out of this is the erosion, not only of financial wealth, but also of trust which can damage participation in financial markets

That’s just till 2014 and the number will be far higher if we include the subsequent years given that ULIPs and hybrid mutual funds became a lot popular due to tax arbitrage and the subsequent mis-selling by banks and distributors highlighting the fact.

Those numbers made me wear adult diapers for a couple of weeks after I read the paper because my otherwise strong constitution went weak. This is just a preview of how rotten and shambolic the business of financial advice is, but hold on to your pants cos 👇

And given that any dumbass can call himself an advisor peddling toxic products and writing quack bullshit, the real advisors, well they’ll have to deal with the collateral kalank.

In numbers…

How many financial advisors do we really have? There are about 2.3 lakh ARN numbers (AMFI registration numbers for distributors) out of which about 88,000 are individual distributors while the rest are employees under larger corporate distributors. According to the SEBI website there are just 1305 Investment Adviser (RIA) registrations. According to the Financial Planning Standards Board site there 1829 Certified Financial Planners (CFP).

For comparison LIC alone has 12.08 lakh agents, not to mention other private insurers.

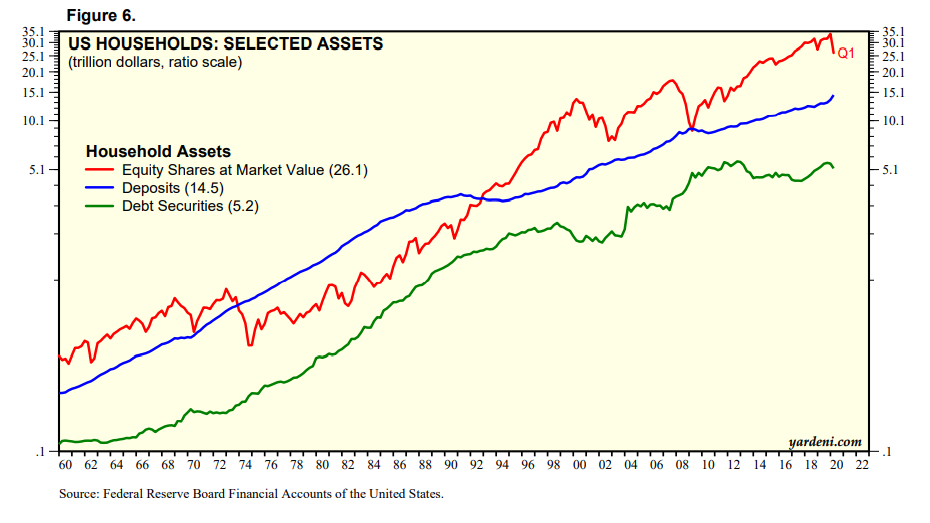

Estimates put the number of RIAs, distributors, wirehouse advisors, independent broker dealer representatives in the United States at over 300,000. These guys are helping household manage over $45 trillion in assets.

Will the real advisors please stand up?

But the questions remains, who’s a real advisor? Here’s where everything gets real fuzzy, real fucking fast.

Are mutual fund distributors actual advisors?

Well, they call themselves advisors but in Feb 2020, SEBI said:

Person dealing in distribution of securities shall not use the nomenclature “Independent Financial Adviser (IFA)”or “Wealth Adviser”or any other similar name, unless registered with SEBI asInvestment Adviser.

SEBI

A distributor sells regular mutual funds and receives trail commissions from the AMC. He’s not required to be a fiduciary. Meaning, he’s not required to put your best interests first. But that doesn’t mean all MF distributors are product pushers. I am guessing given that bank RMs have engaged in rampant mis-selling, SEBI decided that they cannot call themselves advisers.

Before I go any further, just because MF distributors aren’t fiduciaries, doesn’t mean all of them are product pushers, there are some fantastic distributors who are providing quality advice. There also an arbitrage angle to being a distributor over an RIA, I’ll explain that in a bit, hold on to your diapers.

Are Registered Investment Advisers actual advisers?

Sounds like a silly question doesn’t it? You’d obviously guess they are but you are 👇

The SEBI investment adviser guidelines say the following:

An investment adviser shall act in a fiduciary capacity towards its clients and shall disclose all conflicts of interests as and when they arise.

An investment adviser shall act honestly, fairly and in the best interests of its clients and in the integrity of the market.

An investment adviser shall act with due skill, care and diligence in the best interests of its clients and shall ensure that its advice is offered afterthorough analysis and taking into account available alternatives

SEBI

Now, by my guesstimate, there are less than 100 actual RIAs out of 1300. When I say an actual RIA, I mean an adviser who creates a comprehensive financial plan and helps an investor in implementing that plan and provide ongoing conflict-free advice. The rest are either inactive, or are tipsters and scamsters! Yes, you heard me, TIPSTERS. Today, if you want to provide stock and F&O tips, you’ll have to register yourself as an RIA. I’m sure the absurdity of this hasn’t hit you yet, wait for it.

If you have to provide stock tips and F&O tips that will almost definitely result in people losing their money, you need to be Investment Adviser (RIA). In other words a fiduciary, that puts the best interests of the clients above all else. How the fuck does that make sense? I mean, what the fuck? Don’t get me wrong, advisers can use derivatives to hedge a portfolio, which makes sense. But RIAs giving intraday number stock and F&O tips? What the actual 🦆ing 🦆 is that?

For example, all the guys giving tips on this site are RIAs. I’ve no idea if they are right, wrong, capable, profitable, lossmaking. But a person who’s supposed to be a fiduciary providing tips? Come on! There should be a separate designation for that or maybe guidelines for that. And given that these guys provide tips, this inevitably ends up in scams. I had tweeted two of the countless such scams here:

To reiterate, there are just a handful of proper RIAs who do holistic planning, offer tax advice, wills, trust, etc. These are RIAs offering product solutions on platforms like smallcase Publisher, but these aren’t holistic advisors. But, as an aside, we need more such platforms and products in India. Platforms like Publisher, otherwise bring transparency and accountability and enable discovery of products and solutions apart from your mutual funds and PMS’.

Are bank relationship managers (RMs) advisors?

Bank RMs are as much financial advisors as much as drug dealers are medical professionals who care about your health and well being. Banks are to mis-selling what Sachin is to cricket. They have transformed mis-selling into an art. A tiny part of me has some insane respect for banks because they have innovated so much on mis-selling, it’s genius, it’s sheer bloody genius. Think about it, how many of us know people who just went to a bank just to deposit money and came out with an endowment policy? That’s goddamn selling!

As I had written it this post, banks are the biggest distributors of financial products -mutual funds, insurance, risk bonds, AIFs, PMS, you name it. They don’t sell because they are good at it, the sales numbers are a result of fundamentally mis-aligned incentives. These products have high commissions and they are a nice way for bank employees to make money over and above their salary.

And the way these bank RMs sell is an art.

Please trust me, I will scam you!

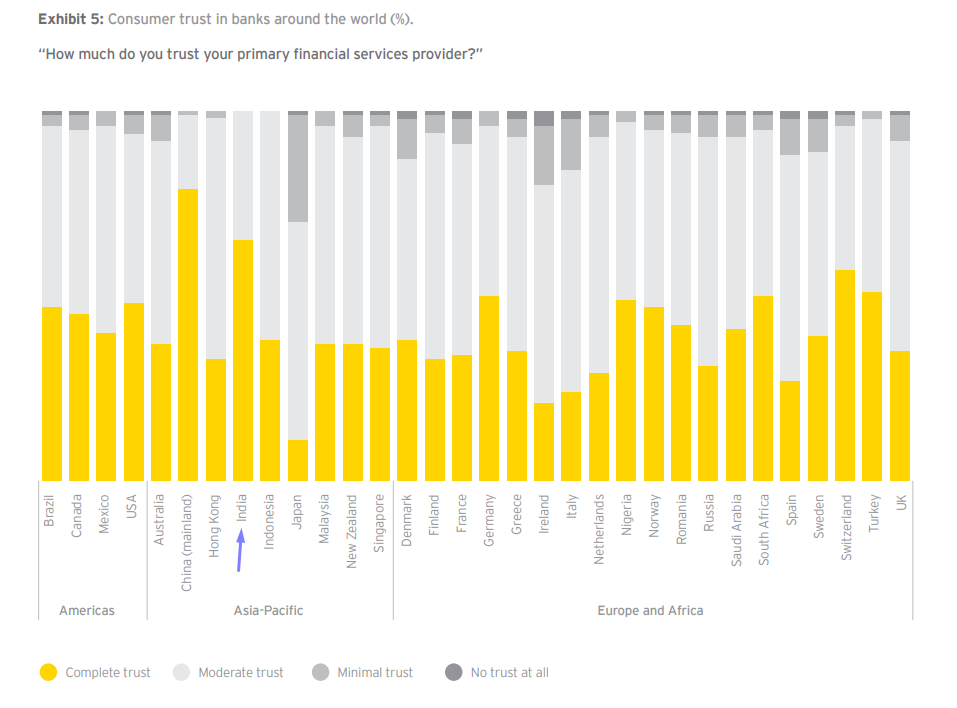

If you think about it, banks are one of the most trustworthy entities we interact with, in our lives. We trust banks to hold our money, our life savings. It shows up in surveys too, here are the numbers from EY’s Global Consumer Banking Survey.

Old people still have long chit chats with bank employees complete with chai, snacks, etc. I can’t count the number of times my dad has spent hours inside a bank talking to some of the employees. Of course, UPI and Paytm have changed to this. But it is precisely this trust bank RMs exploit.

Bank RM Mr Verma: Hi Mr Sharma, long time no see

Mr Sharma: How have you been Mr Verma. How’s the wife and those ungrateful kids you keep bitching about? Your son is still a dopehead?

Mr Verma: Unfortunately yes. Please site down. Would you like some coffee or tea or an Endowment policy? We have an amazing product called Jeevan Anand Dhara policy. This product will bring you happiness to your family (and my pocket of course). After all, the name itself has happy in it! Trust, I’m your friend, I only want what’s best for you. Please have your chai before it gets cold while I scam you.

I’m not kidding, this is how subtly these guys shove scammy products down your throat without you even feeling it. Bank RMs can sell a refrigerator to an Eskimo. Given the high degree of trust people place in banks, these guys exploit it to perfection.

Distributors vs RIAs

Coming back to the topic at hand, have you ever wondered why there’s such a huge difference in the numbers? First up, RIA as a classification is a relatively recent development, SEBI just formulated these guidelines in 2013. It was the same year, SEBI mandated all AMCs to start offering direct plans in mutual funds.

An investment advisor (RIA) is a fiduciary who is supposed to put the best interests of an investor above all else without any conflicts of interest. As such, an RIA is bound by a higher standard of care compared to a distributor. A distributor or an IFA, on the other hand, is just a salesman of financial products. Distributors, by conventional definition, sell whatever fetches them the highest revenue.

An RIA also has higher bar in terms of networth, qualifications and compliance requirements. Distributors on the other hand just have to write a simple exam and they can start selling mutual funds.

This all seems straightforward, doesn’t it? Not so fast, there are several perplexing and weird issues here. A distributor today can provide “incidental advice” to the product he is selling. I’ve no clue what that means, but most distributors today provide full advice. To provide the exact same advice as distributors, an RIA has to conform to far higher requirements.

Another important issue is the nature of fee collection. A distributor sells regular plans of mutual funds and he gets trail commissions automatically for as long as his clients continue investing. Absolutely no friction and he doesn’t have to worry too much. RIAs on the other hand, have to manually charge fees every year, because they cannot sell regular plans of mutual funds.

The thing about fees is, investors don’t care about what they don’t see. In a regular plan, the AMC automatically deducts the commissions and investors directly don’t feel the pinch. So, most investors don’t really focus on the costs. But in the case of an RIA, an investor has to cut a cheque and they will care about what they are paying. And then there’s also the fact that all payments in India have a 2FA authentication, which means we don’t have seamless automated payment collection systems except for NACH mandates, where some friction is still involved.

This is an arbitrage of sorts and it makes being an RIA a little undesirable compared to being a distributor.

Distributors bad, RIAs good?

This where things get fuzzy. If you go by the terms at their face value, distributors are product pushers whose job is to make money so they will naturally sell the products with the highest commissions. RIAs on the other hand are fiduciaries who will offer clean advice without any conflicts of interest. But the reality is not so black and white but rather 50 shades of grey, but far less raunchy😜

There are good distributors and bad distributors if you set aside the bank RMs – they’re all bad. And similarly, there are decent RIAs and morons masquerading as RIAs. How do you pick a good adviser? Well, it’s a lot like picking a good wife, it’s a hit or a miss. You find a good one, your life is like the movie Sleepless in Seattle, if not, then it’s like Evil Dead.

And let’s not forget, without distributors, it is not possible for the mutual fund industry to grow. While I, like many vilify their mis-selling practices, and rightfully so, they do play a vital role in bringing new investors into the fold. If there were just RIAs and no distributors the mutual fund industry at a maximum would’ve had a couple of lakh crores of AUM instead of the 26 lakh crores currently.

Us vs the US

And now, the mandatory comparison with the US. This is a stupid and incorrect comparison because, well, the US markets are far more evolved and larger. The marketcap of all listed US companies over $30 trillion while it’s just about $2 trillion for India. But this comparison is to give you an idea of the possibilities.

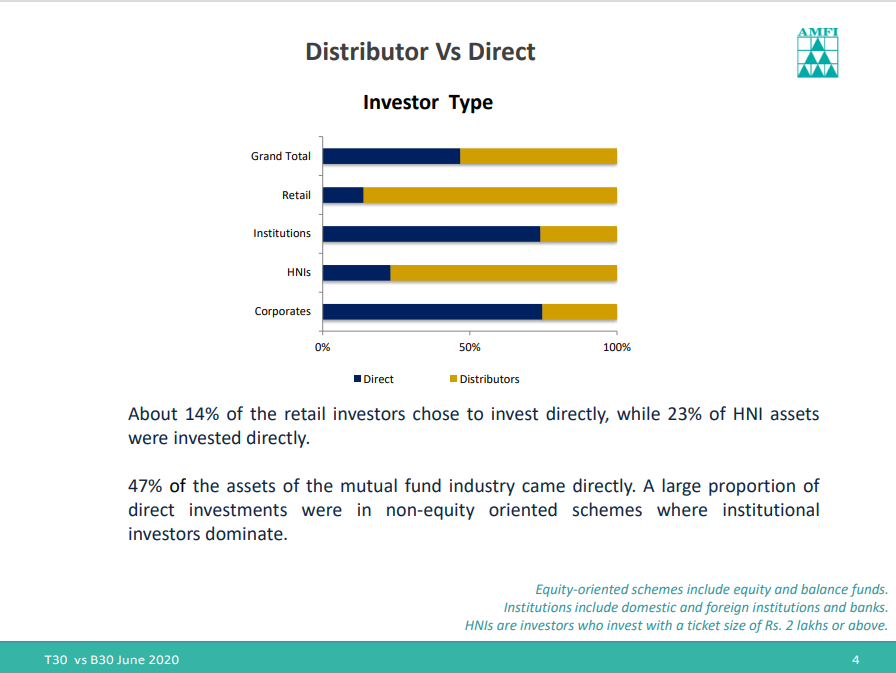

But before that, people often assume that, just because the US markets are developed means, they are cleaner and far more advanced, it’s not. The way financial products are distributed there and in India are a lot similar. In India distributors account for 86% of all retail AUM. Just 14% of the AUM was direct.

In the middle of the post, I mentioned wirehouses in the US. They account for a vast chunk of all the advisory assets. A wirehouse is the US equivalent of a full service broker like ICICI Securities, HDFC Securities etc. Estimates put assets managed by RIAs at about $7 trillion.

Now, unlike, India, things are a little tricky when it comes to RIAs in the US. Advisors in the US can become hybrid RIAs . Meaning they can be both distributors and advisors. Figuring out a breakup of assets between pure RIAs and hybrid RIAs is tricky. Up until recently, this wasn’t possible in India. But in the recent changes to the RIA guidelines, SEBI allowed corporate RIAs to provide both advisory and distribution as long as there is a segregation at a client level.

But the hybrid RIA structure in the US has led to all sorts of abuse, conflicts of interest, and skirting of fiduciary standards that mandate RIAs to put the best interest of their clients above all else. Professor Nicole Boyson published a damming study that showed just how rotten the hybrid or dual RIA structure is:

Dual RIAs offer affiliated mutual funds more frequently than independent RIAs, and they require less due diligence for affiliated funds than for third party funds. Third, beginning in 2003, dual registrants paid over half a billion dollars in disgorgement and civil penalties for inadequate disclosure of mutual fund 12b-1 fees and revenue sharing – conflicts unique to dual RIAs – and the SEC is currently pursuing five additional cases with aggregate potential penalties of over $150 million. These conflicts and penalties occur more often among dual RIAs that accept retail clients. Fourth, retail fiduciary clients of dual RIAs pay higher fees – without an obvious increase in financial planning services – than either dual RIA brokerage clients or clients of independent RIAs. Finally, dual registrants invest RIA client assets in institutional share classes of the same revenue-sharing mutual funds they offer to brokerage clients. These portfolios attract higher flows but significantly underperform mutual funds preferred by self-directed investors and independent RIAs

Nicole Boyson

It’s the same everywhere

Recently there was a huge uproar over the write-off of AT1 bonds issued by Yes Bank, I had written about it a little here. These bonds were heavily mis-sold by banks as “super FDs”. Similarly, in the US, there were a series of leveraged Exchange Traded Note (ETN) blowups.

Let me take a slight detour. Now, if you are hearing about an ETN for the first time, most retail investors confuse them with ETFs, but they aren’t . An ETF is a fund that takes money and invests in the underlying asset. An ETN on the other hand is a debt instrument that promises to deliver the return of an undelying index. The most popular and most traded ETFs tend to be leveraged. For example, the The 3X ProShares UltraPro QQQ is an ETN that offer 3 times the daily returns of the Nasdaq 100. ETNs also have clauses that allow them to close the ETN if there are wild price swings and to stop the share price from going negative. Due the recent bout of volatility 50 leveraged ETNs have shut down. I’ll stop with this because this topic in itself can be a huge post. And we don’t have any leveraged ETNs in India yet.

Anyway, recently UBS, one of the biggest wirehouse shut down a 2X REIT RTN. Reports later came out that these ETNs were heavily sold to retail investors who had no clue how these leveraged instruments worked. In one particular case, a retired college professor lost $700,000.

And in India, we have insurance scams, in the US, they have annuity policy scams. In India, mutual funds are mis-sold, it’s the same there. The point I was making was, people always think the grass is greener on the other side and this keeps coming up in conversations.

Life of an advisor

The reason why I made the US comparison was to talk about the way in which advisors operate. An RIA in India, cannot do discretionary portfolio management. Meaning, he cannot make trades in your account without your consent. And every time there has to be a trade, he has to take your consent. This is a serious hurdle because investors are lazy and they suck at following advice. So, typically, RIAs provide advise and the clients go execute the advice on a MF platform or a platform like smallcase publisher.

But this works differently in the US. An RIA signup with a custodian who is responsible for the safekeeping of client funds and securities. The RIA opens an account for each of his client with the custodian. And most custodians provide the ria with tools to manage his entire practice right from executing trades, billing, compliance, proprietary products, wrap accounts etc. Unlike India, US advisors can discretionarily manage the accounts of their clients. And the custodian takes care of executing the trades, funding etc.

Based on the agreement between the client and the RIA, the custodian also takes care of deducting the fee and giving it to the advisor. And perhaps the most important difference is that Indian advisors cannot automatically deduct fees, there is not way. Investors have to manually make payments which is a massive drawback. The thing about investors is that they don’t care about things they don’t see. This is why regular mutual funds are easier to sell. Investors assume that they are free without realizing that commissions are deducted and paid to the advisors. Now if an investor consults a fee-only advisor who charges less than the commissions he would’ve paid in a regular mutual fund, he’ll still feel the pinch. This is behavioural, we are wired this way.

Of course, some Indian RIAs have found a workaround. When a client invests, they park a portion of the fee in a liquid mutual fund and redeem it based on the fee schedule But this isn’t exactly legal but rather a bit grey. But, hey, where there is friction, there is jugaad.

Apart from the tech provided by the custodians, RIAs have access to some amazing and cutting edge tools to manage their practice.

I’ve checked out tools available to Indian advisors and it’s like comparing Window 10 and Windows 1500 BC. To be fair, there are 7 pure play RIAs to begin with so, there isn’t an ecosystem around them.

And then there are specialized entities called as Turnkey Asset Management Platforms (TAMPs) which allow an advisor to focus on growing their business while they take care of the entire portfolio management from manager selection to trade execution. The advisor isn’t involved at all. The TAMPs are bit like hiring an external CIO. And then there are innovative firms like Dynasty Capital for example, which provides middle and backoffice solutions while you run your own firms. The firm takes care of everything from marketing, compliance and portfolio management.

As an aside, there has been a growing breakaway trend of advisors moving away from wirehouses from Merrill, UBS, etc to setup their own independent RIA practices. Which is an indication of where the future lies. In a wirehouse, advisors are employees of the firm, they don’t own the book.

Like I said earlier, the US comparison is stupid because India is still a nascent market. But even for a nascent market the advisory ecosystem here sucks big time.

Regulatory changes

SEBI had issued four discussion papers before it recently notified the changes to RIA regulations. Some of the changes might just have ensured that being an RIA isn’t a viable career path for anybody wishing to be one.

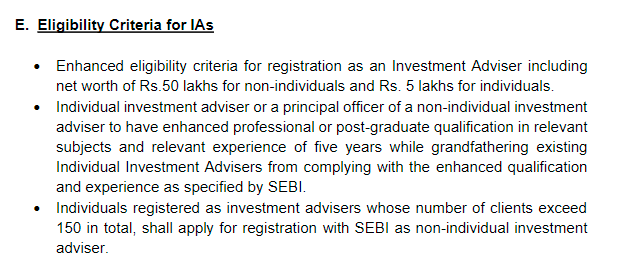

You now have to be a post graduate as opposed to a graduate previously. I don’t get this at all. I just did some cursory Googling as I was writing this post and to be an RIA in the US, you don’t need any educational qualifications. Does your level of education indicate competence? This is more of a philosophical argument and you can argue both ways. But on the other side, I am also sympathetic to the fact that in the absence of anything, educational qualifications might be of some solace to investors. Who would you trust – a 25 year old with an RIA license vs a 25 year old with a RIA license, an MBA and a CFP designation? After all, RIAs don’t have to publish their track records publicly. And on the extreme end, there are people like Michael Kitces who argue that a CPF designation should be a minimum qualification for RIAs. Seems fair and sound fair, doesn’t it? Maybe it might make sense in developed countries like the US where literacy rates and incomes are high.

But in a country like India, where just 8.15% of the population are graduates and there are only 2.08 crore unique investors, this moves seems retrograde. The ideal solution would have to been to have stringent certification exams, comprehensive disclosure, easy grievance redressal mechanisms and oversight.

Even the increase in networth requirements from Rs 1 lakh to Rs 5 lakh for individuals, Rs 1 lakh to Rs 50 lakh for partnerships and Rs 25 lakh to Rs 50 lakh for companies seems puzzling. How is networth an indication of competence? I personally would qualify as lower middle class bordering on the poverty line. But not to brag or anything but I can provide better advice than 50% of all mutual fund distributors and my networth is less a couple of lakhs.

Quoting from this old yet perfectly relevant piece by Sandeep Parekh:

Almost all financial regulations in India favour entities with more money than less. These regulations are often wholly agnostic to whether the entities are competent beyond some minimal standards. This is a pity, given the large number of smart and self-driven people who graduate from the IITs and IIMs and who have everything going for them except a very large chequebook. The regulations provide a virtually insurmountable barrier for these youngsters in India.

While there are some areas that do require capital to run, there are many others which do not. So, while a bank or a custodian requires capital to operate with manageable risk, a portfolio adviser needs no bank balance to operate, as the adviser is as good as the advice she gives. Yet, Sebi regulations require a net worth

Also:

And then there’s this:

Individuals registered as investment advisers whose number of clients exceed 150in total, shall apply for registration with SEBI as non-individual investment adviser.

This is just asinine in my view. If you are a % of AUM based advisor, your earnings tend to be higher. But flat-fee advisors tend to make money only when they serve a larger set of clients. This makes being a flat-fee based advisor undesirable when we need more flat-fee advisors to provide affordable financial advice.

Many people don’t agree but SEBI has been one of the most progressive financial regulators on the planet. I’ve seen measurable benefits of all the moves SEBI has made in the past few years from close quarters but these recent changes to IA guidelines don’t seem particularly well thought out.

But I can also understand why. I think these guidelines have to do with the fact that there have too many scams by people with RIA licenses. But the idea move would be fix the root cause of the problem rather than to impose barriers to entry.

Arbitrage everywhere

Looking at all aspects of life as a series of arbitrage opportunities is mentally stimulating. These moves by SEBI have made being an RIA wholly unattractive but a being mutual fund distributor move attractive. Why put up with all these hassles and requirement while you can just write a very simple exam and start selling mutual funds? By being a mutual fund distributor:

- There are no networth or compliance requirements

- Provide incidental advice

- Fee collection is easy because you sell regular mutual funds and earn trail commissions

Why would anybody willingly become an RIA?

The advisory ecosystem is dead, long live the advisors

One of the reason why the US capital markets have grown so big is because of the advisory and distributor ecosystem. Financial inclusion doesn’t just increase just because you hold your hands and pray. Financial inclusion is a result of advisors and distributors bringing new investors to the fold. While mutual fund distributors too have issue like higher taxes, shrinking margin, their lives are a lot easier compared to somebody who wishes to be an RIA in India.

With these restrictive regulations I think, SEBI might have just killed of the nascent RIA movement in India at a time when the exact opposite was necessary.

Think about it, how does an Indian investor get unbiased financial advice? There are 2 crore unique mutual fund investors and just under 100 RIAs who offer holistic advice. If you include the advisors who offer packaged solutions like the ones on smallcase Publisher that might go up to 200 maybe? Bank RMs whose sole job is to shove unsavoury and disgusting financial products and mutual fund distributors where your chances of getting good advice is a hit and miss dominate the landscape.

Platforms are even worse when it comes making investing easier. Most of these platforms call themselves robo-advisors which is kinda ironic and stupid. To be a robo-advisor, your platform needs to be robotic aka automated. None of the platforms are automated simply because regulations don’t allow them to be. Which means at best mutual fund platforms in India are semi robo-advisors. Most of these mutual fund platforms – both direct and regular are doing more harm than good to investors with their stupid ass back ward recommendations and a fundamental misunderstand of what investors need. I had written about it with more specifics here.

Off late there has been spike in the number of idiots masquerading as advisors selling options trading webinars, stocks tips etc and charging lakhs of rupees. Not a day goes by on twitter when I don’t come across a gullible person falling for one of these get rich options trading seminar scams.

Could these kind of scams reduce if we had a more robust advisory ecosystem? Expecting them to completely go away is wishful thinking, as long as there is human greed, such schemes will continue to cater to them. It’s simple supply and demand. But if we had more advisors, is it plausible that the number of victims of such scams could reduce? I leave that to you.