We human beings are suckers for good stories. This how we make sense of the world. We are hardwired to seek patterns where none might exist. Stories are also how we sell things that otherwise people wouldn’t touch with a 10-foot pole, toxic insurance polices being a prime example. It’s absolutely brilliant how we neatly arrange events in a sequence to construct meaning, much like poetry while discarding events, even important ones that don’t fit in the story.

Just as the brain detects patterns in the visual forms of nature – a face, a figure, a flower – and in sound, so too it detects patterns in information. Stories are recognizable patterns, and in those patterns we find meaning. We use stories to make sense of our world and to share that understanding with others. They are the signal within the noise. So powerful is our impulse to detect story patterns that we see them even when they’re not there.

Frank Rose/Wired

Stories or narratives are even more important in financial markets as Nobel Laurate Robert Shiller showed in his recent book. Narratives move stock market prices, perhaps more than fundamentals itself. Sometimes, narratives are more important than the truth itself.

The problem with theories or narratives that counter a false narrative is that they might not be contagious, it’s just not fun.

Robert Shiller

Robert Shiller also compared narratives to diseases, and I think that’s brilliantly apt. Currently, there is a rather stupid and contagious narrative about novice daytraders or the so-called “Robinhood traders” entering the markets in droves and moving the markers.

The term Robinhood traders has become a catchall term to describe all the people who have entered the markets since lockdowns were imposed across the world. The media, the talking heads, stock gurus would have you believe that there is an epidemic of young and dumb people entering the markets and trading their money away, causing bubbles in stocks, moving the markets away from their fundamentals. They would have you believe that these people are spitting on the grave of Ben Graham and are pushing the financial world towards a crisis that would make the dot com crash and the 2008 crash look like a 90s duet.

Plenty of Indian fin media houses, gurus, fund managers, so-called advisors are parroting this bullshit in India as well. How does this narrative hold up? Let’s take a peek under its lungi, shall we?

Even distributors and the so-called advisors have been writing absolute rubbish about this to sell their overpriced products. These sanctimonious prudes were the same people selling dividend plans of balanced funds as guaranteed divided products to retirees but more on that later.

This stupid, annoying and utterly idiotic narrative has become a dominant talking point and has firmly taken root in mainstream financial reporting. So much so that disparate moves in the markets are being attributed to these new traders who’ve entered the markets post COVID-19. Everybody from otherwise sensible people to frustrated mutual fund and PMS managers whose value investing strategy seems to be down in the gutter are pushing this narrative, and this is just getting on my nerves!

I’ll try to break down this super smelly bullshit the best I can.

Prelude in numbers

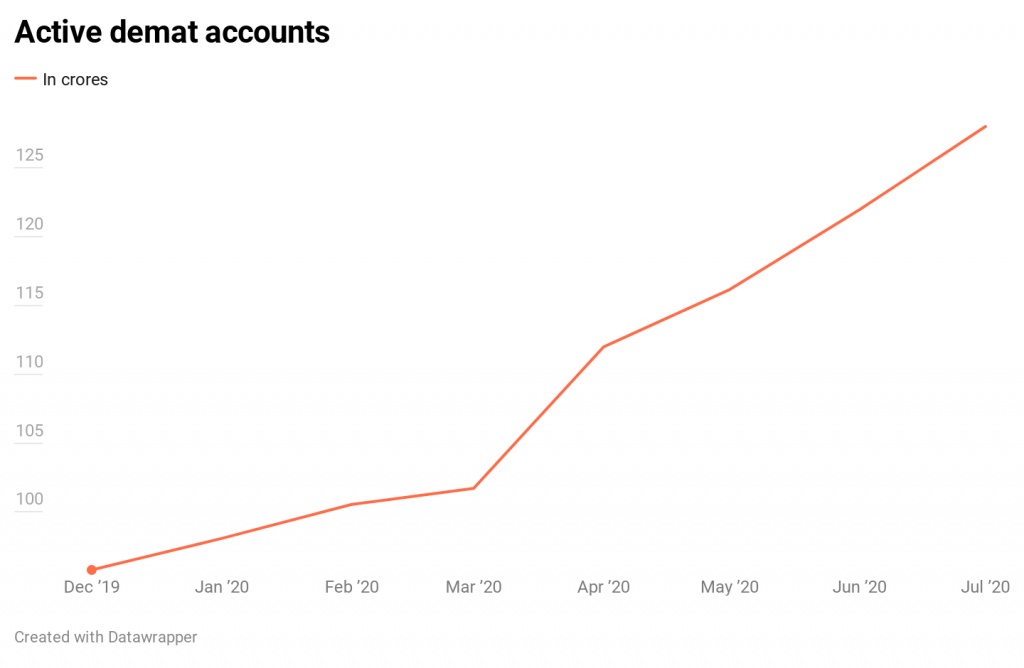

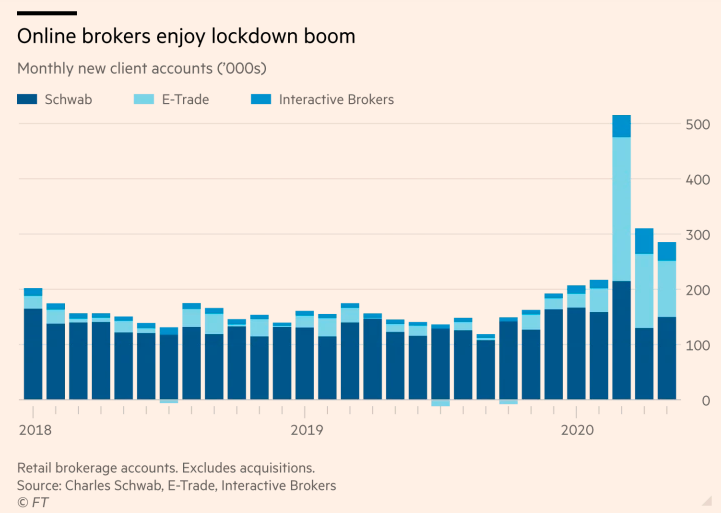

Why did this narrative take root? I think this came as a bit of a surprise for market watchers. Typically, when there is a market crash, retail investors tend to flee the markets in droves. But this time around, even though there was enough volatility to give people a heart attack, there was a massive influx of new traders and investors across the world. Yes, this isn’t a uniquely Indian or a US phenomenon. The top online brokers across the world reported massive growth in new clients.

This while the global economy was virtually shut down, nearly 14 million Americans and many more across the world lost their jobs. To contain the economic fallout, the US Govt announced a $600 per week unemployment benefit. Turns out many of the people receiving these cheques started trading. A novice trader who didn’t understand options trading even committed suicide after seeing a negative balance of $730,165 in his account because he thought he had to pay that, which he didn’t. The number was just a result of unsettled options trades.

And these kind of stories were enough to send the financial journalists around the world who were copped up at home and had difficulty coming up proper stories into a tizzy. A barrage of such salaciously headlined articles became the norm.

India

Growth in new accounts: Top 10 brokers as of Nov 19

Online brokers and discount brokers saw stunning growth once the lockdowns were imposed.

Active demat accounts

Cash market volumes

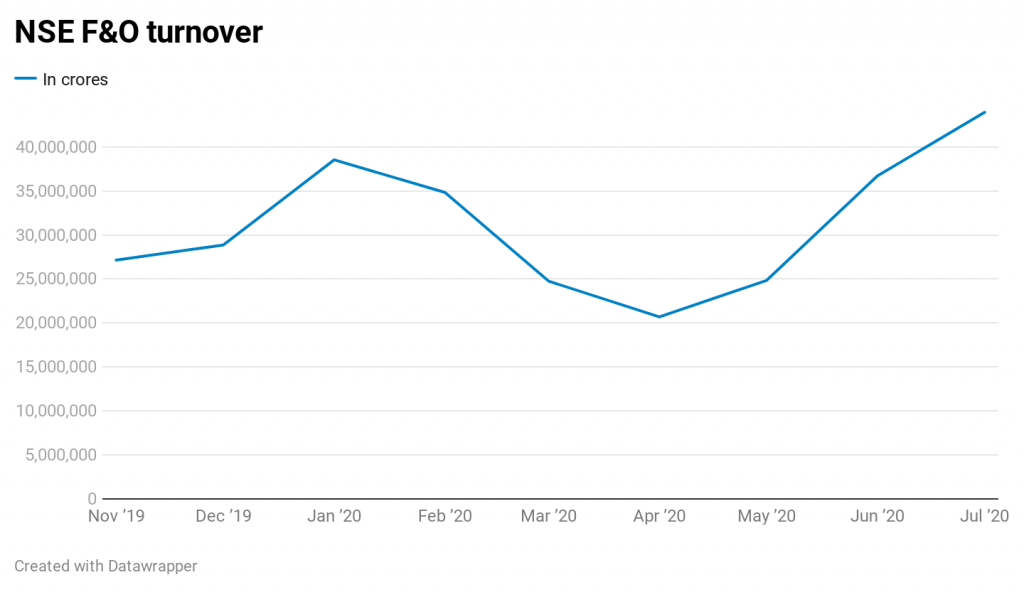

NSE F&O turnover

In the United States

Robinhood reportedly added 3 million users just this year. Fidelity added 2.2 million accounts, Schwab, TD, E*Trade added millions more.

Why?

I don’t think it’s one particular thing causing it, but rather there are a bunch of reasons like always. I’ll list down a few of the reasons for this phenomenon, both my own as well as those by some really smart people.

Boredom markets hypothesis

This is one of my favourite theories by the brilliant Matt Levine. We haven’t had a situation in contemporary times where we voluntarily and simultaneously shut down the entire global economy and put a full stop to pretty much all of the outdoor activities. Why do you do when you’re locked, and everything you’d otherwise normally to keep your miserable self entertained is not an option?

The weird thing about the coronavirus crisis is that it simultaneously (1) caused a stock market crash and (2) eliminated most forms of fun. If you like eating at restaurants or bowling or going to movies or going out dancing, now you can’t. If you like watching sports, there are no sports. If you like casinos, they are closed. You’re pretty much stuck inside with your phone. You can trade stocks for free on your phone. That might be fun? It isn’t that fun, compared to either (1) what you’d normally do for fun

The stock market as entertainment

This is an extension of the first theory. What do you do when pretty much most commons forms of entertainment such as movies, sports or travel are shut down? What’s left that that could give you entertainment or a rush? The stock market qualifies, doesn’t it? Think about it, if you switch on CNBC and login to your trading account, you won’t even notice how 7 hours fly by. The markets on a daily basis have enough pointless thrills and chills to keep you occupied. For many, the market is probably the biggest dopamine rush:

A small part of the brain, called the nucleus accumbens, is responsible for evaluating and reacting to our experiences. It is the “pleasure center” that responds to all sorts of things, including good food, chocolate, alcohol, sex and, of course, thrilling financial trading. The brain actually produces an opium-like substance called dopamine that rewards the brain’s pleasure centers.

Investopedia

Good ol’ gambling

The online gambling market is estimated to be nearly $50 billion and sports betting accounts for the lion’s share of the activity followed by casino games. As the pandemic spread across the world, all the major sports leagues across were shut down. Real-world casinos were also shut down and only started reopening in the past month or so. What do you gamble on when your usual options aren’t available? The stock market is as good a place as any. You can place highly leveraged YOLO bets using options. If you want to gamble for a bit longer instead of a levered blow-out, you can gamble on stocks. Bankrupt and loss-making companies like Hertz and Kodak were some of the most popular stocks among Robinhood traders. In India, penny stocks have always been evergreen favourites among the retail junta.

The same pattern has played out in other parts of the world. Plus 500, an online service provider for trading Contracts for Difference (CFDs) internationally, put up monster results for its first quarter. It made in one quarter ~90% of the revenues it made in the whole of last year. Those revenues came on the back of more customers, higher customer activity and came with lower customer acquisition costs. Continued customer acquisition and high deposit levels going into the second quarter set the company up well for continued strong performance.

Net interest

Just more time to think about money

This is my own theory and the one that comes up the least because it is boring and ain’t flashy. I’ve personally had calls with my friends wanting to invest because they finally have had the time to think about saving and investing now they’re are cooped up at home. On the other hand, I’ve also had calls from friends asking me if they can make a thousand bucks a day from trading

Just like there were a lot of idiots entering the markets lured by the prospect of quick bucks, there were a lot of sensible people who’ve started investing for their long term goals. And we’ve seen this from the fact that just like online brokers, all of the online mutual funds platforms had their best ever months from March onward. The pandemic and the resulting job losses and pay cuts did force some people to think about getting insurance and build a nest egg.

But writing a headline that “Millions of long term investors are entering the markets” isn’t as flashy as “Novice Robinhood traders are pushing the Indian markets to new highs and aren’t bothered by valuations”.

Now, to the bullshit

Novice Robinhood traders are moving the markets

To even utter this phrase shows the lack of understanding of how markets work and the participants in it. It is very hard to figure out how much individual investors contribute to the overall data, but here’s the best I know. Every month NSE publishes a report called Market Pulse in which it breaks down the segment-wise market turnover by participants. In the graphic below, the others category includes individual retail investors, NRI, HUFs, trusts and others.

On the face of it, you can jump to the conclusion that retail investors control the market, but not so fast. Now consider the fact that there are just about 1.3 crore active demat account in India and this a non-duplicate number. If I have five demat accounts and if I have made a transaction in all 5, it would count as 5. Conservatively, I’d guesstimate that there won’t be more 50-60 lakh unique demat accounts. So, it’s somewhat stupid to say that novice individual traders are moving the market. This data isn’t granular enough.

But hang on, what if I told you retail investors have always moved and manipulated stocks? Except for the top 200-300 India stocks, liquidity quickly starts drying up in mid and small-caps. And these stocks have been hotbeds for manipulation. Retail investors by jumping into stocks that have been pumped up through messages, tweets, business news channels have been unwittingly manipulating stocks for ages now. I’d even written about a few cases recently. There was even the egregious case of Ruchi Soya, which went up 9000%, the reason being only about 1% of the company’s shares were outstanding.

More importantly, what stocks are they manipulating? Large-caps? Mid-caps? The entire market? Do people have any idea how much it takes to move large-caps? Look retail investors can’t really move zilch! At best, at best, they can just influence the movements of certain mid and small-cap stocks which have a low float or are pump and dump targets. This has been the case since the NSE and BSE started, how the hell is is different?

To say that these people have entered the markets in droves and are bidding up stocks is a bit like saying watching Bollywood movies can cure skin allergies. They’re not even bloody related!

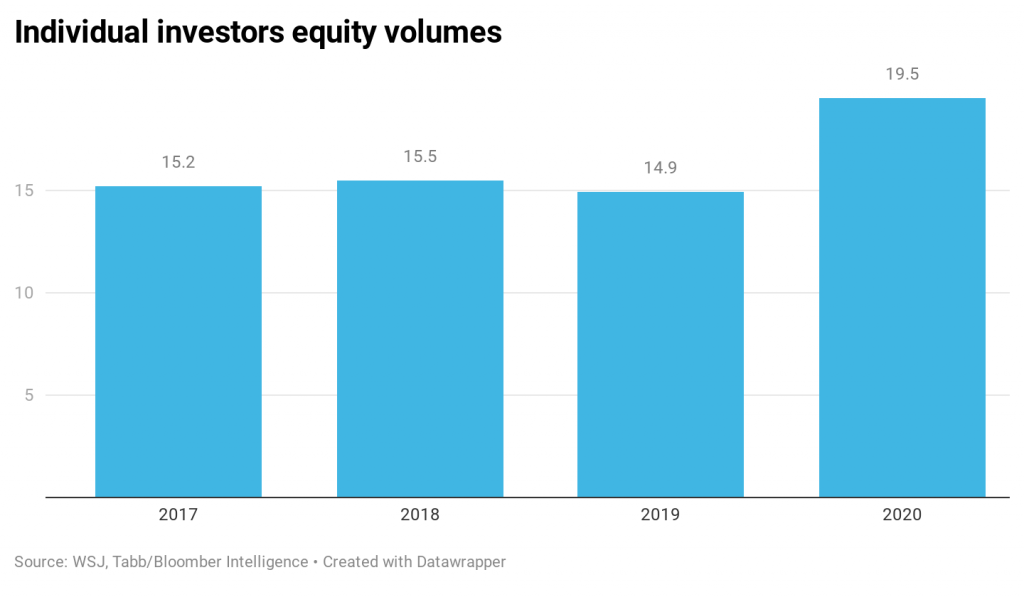

For context, this is how much individuals contribute to the US stock trading volumes. There are far bigger sharks and whales capable of moving the markets than these mostly clueless idiots betting on kachra stocks.

The reality of this nonsense

Robinhood traders – availability bias

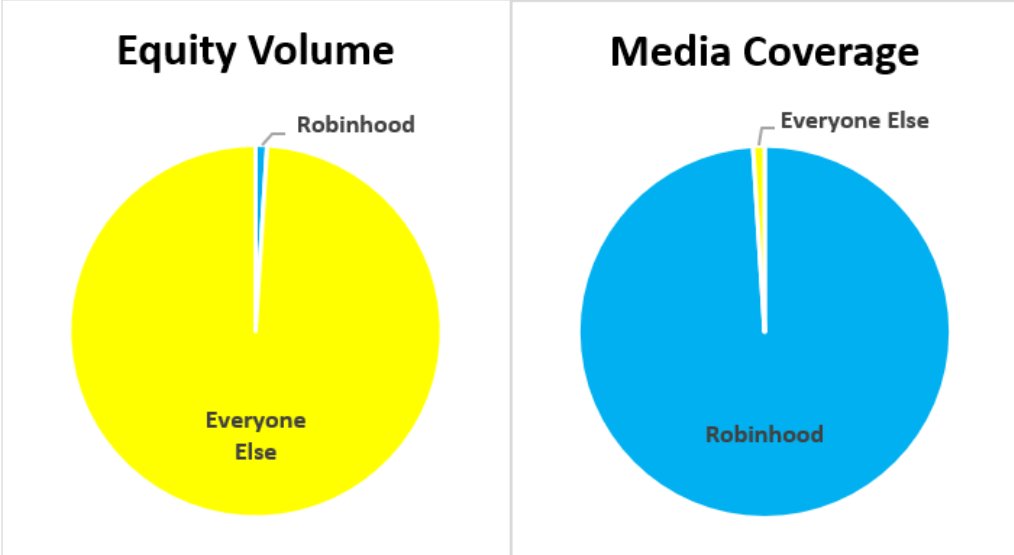

Why the “Robinhood traders” label?

This has been bugging me a lot. Why are all these traders collectively labelled “Robinhood traders” even by Indian media? Why not Schwab traders or Ameritrade traders, or Fidelity traders, or ICICI traders? Because even the other brokers have opened millions of new accounts. Before that, some content if you are new this whole thing. Robinhood is an online or a discount brokerage in the US that was founded in 2013. At a time when other large brokers like Schwab and Fidelity were charging $10-$15 per trade (YEAH, NOT Kidding) Robinhood started charging 0 brokerage right out of the gate.

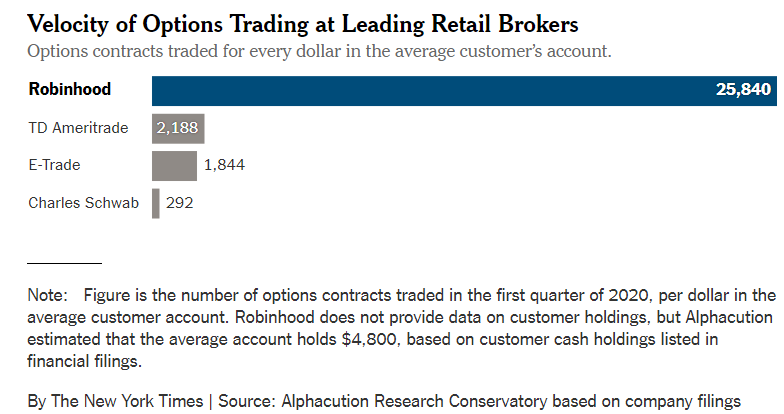

They just had a really simple no clutter mobile app which made trading stocks and options as easy as a couple of taps. This video gives you an idea of how easy it is to trade on Robinhood. You can trade an options contract just by choosing the direction you are betting on!

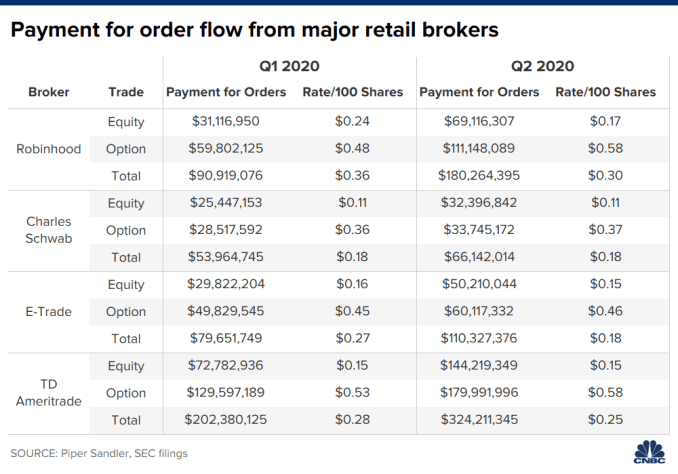

You might be wondering if they are free, how do they making money. Here’s where things get pretty controversial. In India, when you place an order for a stock, the order directly hits the exchange where it is matched and executed. In the US, things are a little different, and the stock exchange scene is pretty fractured. Yes, there are exchanges, 13 of them in fact but there are also liquidity pools outside the exchange rather ominously called dark pools and also market makers who execute trades.

So, a US broker need not send orders directly to the exchange. It can instead send the order flow to a market maker like Citadel or Virtu who’ll give a slightly better price than and then split the fee from that price improvement with the broker. Why will they provide a better price? Because they would’ve probably bought it for lower, they continuously provide 2-way quotes and eat the spread. These firms are huge and execute thousands of trades in a matter of seconds, and the more they keep doing this, they end up with more profitable trades than negative trades.

Now to be clear, these market makers cannot rip you off, there is a law that requires these brokers to execute orders at the best available price. There’s a lot of controversy over this practise because people think they retail traders are being ripped off and they’re being thrown to the wolves, which isn’t the case. It’s just that this practice is seriously misunderstood and is a case of a molehill being turned into a mountain.

So, Robinhood sells order flow and makes money from it, which is how it was able to offer 0 brokerage. Robinhood also quickly became a target over this practice, again unfairly because every major broker was doing ait and making wayyy more money than them.

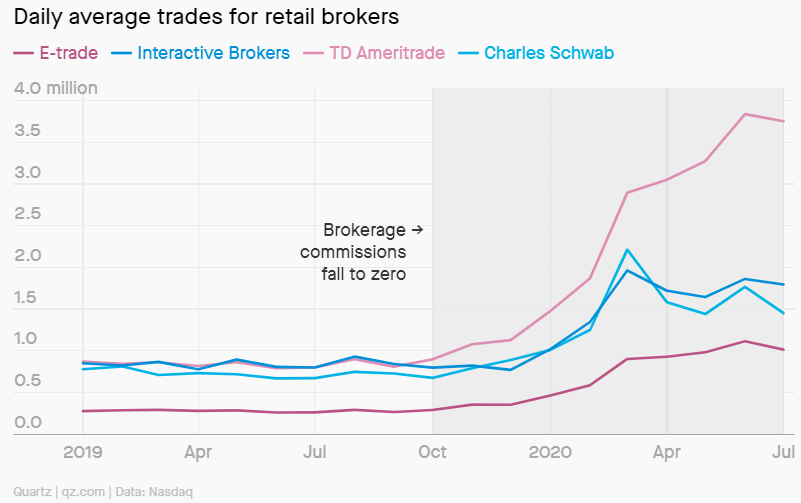

But in things like this context doesn’t matter. Just the loud and utterly stupid headlines. In September-October last year, a major fee-war broke out among the large brokerages. Interactive Brokers and Schwab went free, forcing the likes of TD, E*Trade, Fidelity and others to follow suit and Robinhood played no small role in this. And it didn’t make a lot of friends by being the first one to go 0 and part of the hatred that it attracts can be explained by this.

But anyways, Robinhood quickly became a favourite among millennials and the younger investors and traders, because it had made trading easy and as people argue, a little too easy and addictive but that’s a whole another debate. It was a refreshing approach to trading and investing compared to the clunky, cluttered, confusing and intimidating desktop trading terminals offered by other brokers. It quickly became a darling among venture investors and has so far raised $1.7 billion, and the last round was at a valuation of $11.2 billion.

Now, given that it made trading so fun and accessible, it quickly became a target of sanctimonious talking heads that it was inducing millions of unwitting millennials to trade and lose their money. It’s true to an extent, but you know what else is true? So are other brokerages which are several orders of magnitude bigger than Robinhood like Schwab, Ameritrade etc. So this label of Robinhood traders is just misleading and a result of lazy flapping of the gums and frankly some really lazy journalism. Stockbrokers make money when people trade more, and it doesn’t matter to them if you make money or lose money, they make their brokerage. And brokers have been doing this since the 1600s when the first stock exchange was formed. How is this new? Why was there no hue and cry that brokers like Schwab, TD, E*Trade were allowing millions of Americans to gamble their money away? Or in the Indian context brokers like ICICI, Sharekhan, HDFC? You’ll see these articles for online brokers like 5 Paisa, Upstox, Zerodha and others though. This has to be the stupidest argument I’ve come across.

But this goes to highlight the power of labels and nicknames. Donald Trump wittingly or unwittingly harnessed the same power of labels when he became the president. Remember the nicknames like crooked Hilary, low energy Jeb, little Marco, shifty Schiff? These names struck a nerve among people who stood supported him. It’s same in the case of the label Robinhood traders as well. It’s just an easy target, and it can be used to extrapolate the behaviour that has existed since the dawn of time and blow things out of proportion.

This is an example of some seriously lazy reporting

Now to the next narrative

Retail investors are trading their futures and their lives away

This is another equally asinine thing that has become a truism alongside the Robinhood traders nonsense. Let me ask you when have retail traders not traded their hard-earned savings away? Millions of doe-eyed retail investors and traders have driven by greed always lost money and will continue to. It’s just with this pandemic and with them cooped up inside their houses, they have more time to gamble away. Nothing has fundamentally changed. So, before the lockdown, if say 10 million Indians or American gambled in the market, you got zero headlines, sanctimonious sermons and tweets. But now that 20 million people have started trading, it’s an “epidemic of retail investor trading”?

What really gets on my nerves, this stupid narrative is bought by people. But the brilliant thing about this how the product pushers have co-opted this narrative, it’s pure genius. So-called advisors have been advertising that if you don’t want to be a Robinhood trader who’s lost his house, wife, and kids, then you need them. The paid stock market newsletter guys, bloggers and have done the same and by the looks of it seems to have worked.

Retail/Robinhood investors are making money so far, but can it last?

What do I even say about this? People make money and lose money, like always. I am not able to figure out why this time is special. When have retail traders ever made money? There hasn’t been comprehensive research on whether daytraders make money or lose money, and most evidence has been anecdotal. But there have been a couple of studies in Taiwan [1] [2] that show that 8 out of 10 traders lose money, only a small group of people or institutions make money off dumb retail traders.

Moreover, in the typical six month period, more than eight out of ten day traders lose money. Despite these bleak findings, there is strong evidence of persistent ability for a relatively small group of day traders. Traders with strong past performance continue to earn strong returns. The stocks they buy outperform those they sell by 62 basis points per day. This spread is sufficiently large to cover transaction costs

Individual investor trading results in systematic and economically large losses. Using a complete trading history of all investors in Taiwan, we document that the aggregate portfolio of individuals suffers an annual performance penalty of 3.8 percentage points. Individual investor losses are equivalent to 2.2% of Taiwan’s gross domestic product or 2.8% of the total personal income. Virtually all individual trading losses can be traced to their aggressive orders. In contrast, institutions enjoy an annual performance boost of 1.5 percentage points, and both the aggressive and passive trades of institutions are profitable. Foreign institutions garner nearly half of institutional profits

So, what’s the fascination with this time? True, some retail traders might have made money buying the dip. But most retail traders always lose money, whether it is this time or the next time. They are biggest suppliers of alpha in the markets to the smart people.

Million of people are being induced to trade

This is a half-truth. Have some of the platforms like Robinhood made it a little too easy for novices to trade? Sure. But they aren’t entirely to blame, the guy choosing to gamble his saving away is to blame. These platforms aren’t sending thugs to people’s houses to put a gun to their head and force them to trade.

Having said that, once a gambler always a gambler. A gambler who wants to gamble his or her money away will always find outlets to gamble his money away. It’s just that with casinos being shut, the stock market has become a destination for the degenerate gamblers.

So, this is another really stupid argument. If you want to go into a gun store, read the warnings, ignore them, and still choose to buy a gun and shoot yourself in the ass who’s to blame? The gun or your bum?

But, just but, hold on

On the flip side, some “behavioural experts” reckon that these platforms are hacking human behaviour to induce us to gamble our money away.

Here’s Thomas Ramsøy, a neuropsychologist speaking to WSJ:

Robinhood and other newer trading apps such as eToro USA LLC and Webull Financial LLC inherit design elements from tech companies that influence user behavior to desired outcomes: Buy a product, use a service, view advertising. Traditional brokerage apps are stodgy. Robinhood blasts users’ screens with digital confetti and makes Netflix-style recommendations for stocks to buy. Buttons tapped to buy a stock are bigger and brighter than those for canceling a trade.

Such cues can exacerbate humans’ behavioral biases and can affect investing behavior, said Thomas Ramsøy, a neuropsychologist who is chief executive of Neurons Inc., an applied neuroscience company.

“If it feels right, we tend to go for it,”

Here’s John Coates, a former trader when asked by a Quartz journo if these trading apps are taking cues from the attention economy:

The design of your screens has a huge effect on risk-taking decision making and I’m appalled at how little has been done on it. Visual neuroscience is a very sophisticated field, and there doesn’t seem to be any borrowing from it at all in the design of screens. Right from really simple things, like how to group information so you can take it in at a glance, to more difficult but obvious ones, like how you design screens that minimize fatigue.

But you could also design screens that lean against this dopamine effect of gaming and uncertain rewards.

And I agree, some these financial services companies might design things to take advantage of our behavioural flaws and basest instincts. But on the flipside for every Robinhood, there’s a Betterment which has long focussed on investor behaviour and build in nudges made famous by Richard Thaler to stop investors from making silly mistakes on its platform.

But I don’t fully buy the argument that these platforms are overtly and egregiously harnessing our attention and flaws. This is a bit of straw man’s argument. If all the people come on the platform and gamble their money away, there isn’t an infinite supply of suckers. So, they do have some incentive to keep you alive. To what extent are they educating the users and doing things to stop people from doing harmful things is a whole another debate.

As for this argument that these companies have designed the platforms that bring out the worst in us, this isn’t a totally logical argument. Simplicity on its own doesn’t induce people to gamble. I can also argue that, just by virtue of Robinhood’s or a Upstox or a Zerodha’s simplicity, they have bought in millions of new investors who would’ve otherwise been intimidated by the existing clunky and cluttered platforms. This argument cuts both ways, and as always the reality lies somewhere in the middle.

To all the Cassandras, with absolute scalding hate

And I reserve my most venomous and special hate for what I am about to write and this is dedicated to all the loud Cassandras who’re just bending this narrative to hawk their shit.

Here’s the Oxford definition of Cassandra:

A person who predicts that something bad will happen, especially a person who is not believed

Now, I’ve broadly summarized all the insanely empty, stupid and utterly annoying and asinine narratives that are being strewn around. But here’s another side of this stupid narrative that isn’t talked about often. Platforms like Robinhood have done more to increase financial inclusion than all the advisors, product pushers, and other whiny talking heads put together if they had ten lifetimes. Robinhood alone had added 3 million users this year. Schwab, Fidelity, TD have added millions more. In India, the likes of Zerodha and Upstox have bought in lakhs of new investors. Digital mutual funds platforms are seeing their best growth ever.

Not just stocks, even mutual funds

This isn’t just newbies entering markets and gambling on options and penny stocks. All the online mutual fund platforms in India and robos elsewhere have seen at the very least high double-digit growth and triple-digit in other cases in investors and net new flows. But on the flip side given the pandemic and the job losses, plenty of people have also stopped their SIPs and may never invest again. This is visible in the data:

Close to 65 per cent of assets are under the ‘less than three years’ bucket, with 47 per cent of assets in the ‘less than two years’ category.

Only 17 per cent of SIP assets are over the five-year mark, which is considered ideal for equity investments to even out the impact of market volatility.

Jash Kriplani, Business Standard

These new investors are people who otherwise might have never invested or would’ve delayed investing. Having seen all the shenanigans of the financial services industry to rip off the investors, I consider this as a massive win.

The ideal way to do this in an ideal world would’ve been to teach kids about money from a young age, make personal finance a core part of the school and college curricula, empower and incentivise people to become fiduciary financial advisors, regulate financial service providers to do more to safeguard investors and add stringent deterrents to stop unscrupulous actors and so on. But we don’t live in an ideal world, do we?

So all the sanctimonious people spewing their nonsense should be ashamed of themselves. I’ll also concede that me writing that this itself is another narrative. So I leave this to your bullshit filters.

And now the media, the stalwarts of the show

Recently someone online called CNBC TV18 as Cartoon Network, and I replied that’s an insult to Cartoon Network which at least provides some value. There is no financial media for most parts, it has become as Joachim Klement calls it “investotainment”.

Media as a whole is in trouble, traditional media particularly so. They are losing ad revenue and fast. In order to make up for the revenue loss media outlets and publishers, including financial press, have abandoned substance in favour of sensationalism, clickbait, and entertainment. CNBC, Bloomberg etc. run 24-hour financial media channels. I can assure you financial markets aren’t interesting enough on a day to day basis to generate 24 hours of content. So what do you do as a financial media outlet? Make things up, manufacture new things and sensationalize the trivial.

This whole Robinhood traders narrative has been sensationalized to end. The real narrative is just plain boring in my view “millions of new traders enter the markets during the pandemic”. Now compare this headline which is closer to the truth with “Robinhood traders are going to get their fingers burnt” or “Billionaires keep blaming Robinhood traders for skewing stock prices.”

We’re all suckers for a good story. Good stories with victims are particularly more powerful. In this case, an epidemic of retail trading is ruining millions of lives. What horseshit!

This goes on to show how financial journalism lost it’s plot a long time ago. Today it’s like a hyperventilating 30-year-old kid with anger issues hopped up on coke and meth.

There is no news in their reporting that is useful for investors or research analysts. To the contrary, the risk is that by exposing oneself to the “investotainment” providers like CNBC or the more serious outlets like the Financial Times, one gets caught up in the sentiment swings of the broader public and ends up being something that academics euphemistically call “noise traders”.

Klement