Before you start reading the post, just a small background. Recently, several large stockbrokers in the United States such as Schwab, TD Ameritrade, and Fidelity went free. This was interesting for a whole lot of reasons I’ve outlined in the post. Thinking about what’s going on in the US and comparing it with India was an interesting thought exercise. I’ve outlined my views in this post. There’s plenty you may disagree with or want to spit in my face for, so please leave a comment

The financial services industry is under an intense siege. A combination of technological changes, new age nimble startups, market shifts and demographic changes are driving costs to zero or near zero. In the last few years, an intense fee war has gripped all corners of financial services from asset management to banking to wealth management to back-office services.

The latest flareup in the fee war was among the online stock brokerages. To be fair this has been a long time coming. Ever since Robinhood launched a zero-commission trading platform, it was just a matter of time before the incumbent giants had to react to protect their market share. This is the most widely reported narrative, not that it’s false but there are other sides to this story. It all started on Sep 26 when Interactive Brokers launched a new commission-free trading service called IB Lite and later on Charles Schwab and other big brokers went commission-free. Actually, if you back up a little, you could say that this all started with Vanguard. Yes, that’s correct. Back in June 2018, Vanguard had announced that it was making about 1800 ETFs commission-free on its platform. If you’re wondering why this is important, you need to know a couple of things first.

Just like we have regular and direct plans in mutual funds in India, US mutual funds have something called as share classes such as Class A, B etc. and similar to direct plans, they have no-load funds. Each share class has a different commission (load) structure. All these brokerages make a good chunk of money by offering funds with different loads. Another important thing to know is that whenever you buy a stock in India, it is held in a demat either with NSDL or CDSL of which your broker is a participant of. But in the US, it’s a little different. All the major brokers are custodians. Custodians are responsible for the safekeeping of client assets, maintaining shareholder records, processing corporate actions etc. similar to RTAs in India but for stocks.

Also, advisors are extremely influential in the US. They can make or break an ETF or a mutual fund by directing fund flows. They also wield sizable influence on the cost of funds and in the past decade or so, advisor fees have remained stubbornly high while expense ratios have been cut in half. More on this later on in the post.

This is largely because advisors kept moving to low-cost mutual funds and ETFs while keeping the advisory fee almost at the same level. Unlike India, advisors can directly implement portfolios for clients and trade on their behalf. To do this, they need a custodian to hold their assets.

Custodial platforms, to an extent, are walled gardens. They control the products available to the advisors. Also, the custodial business is a low-margin business, which means it’s all about scale. Typically the margins range between 18-25 bps. Which means most of the money they make is from cash spreads, mutual fund commissions, proprietary products, and so on. To give you an idea of the landscape, Fidelity, Pershing (BNY Mellon), TD Ameritrade, and Charles Schwab are the four biggest custodians.

When ETFs became popular among investors and advisors, it became a problem for these platforms because they didn’t earn any commissions from ETFs. So, these brokers launched no-transaction-fee (NTF) platforms and told the asset management companies to pay them if they want their ETFs to be listed on them. These arrangements are commonly known as “pay-to-play” arrangements.

These payments can be in the forms of basis point fees on the total assets held at the custodians, sponsorships for events, training programs for the employees of platforms, and so on. So, the investors and advisors who used these brokers didn’t pay anything to use ETFs listed on these NTF platforms but the asset management companies used to pay the broker. Mind you, not all ETFs were available on these NTF platforms but rather select ETFs by AMCs which paid the brokers.

Now Vanguard is notorious for not paying these sort of commissions because it is a mutual company. Meaning the company is owned by its funds which are in turn owned by investors. Vanguard’s sole duty is towards investors, and it passes on the profits it generates to investors by reducing expense ratios. Over a period, these platforms started restricting or removing Vanguard funds because they weren’t getting any money from the company. So, Vanguard launched its own commission-free trading platform as a giant fuck you to all these platforms. In essence, Vanguard has scored a giant victory with all the major brokers which are also custodians going commission-free. It can now see more flows from all platforms given that everybody is zero while not paying anything to these custodians.

It didn’t take long for the dominoes to fall. Charles Schwab set the ball rolling when it announced that it was going free and on the same day, TD Ameritrade followed suit. E-Trade, Fidelity, Ally Invest, Alpaca, the API based stock brokerage, Merill Lynch, Raymond James, UBS were all forced to follow suit.

Here’s how the stocks reacted after Schwab first went free.

Even the stocks of asset managers who were a big part of these NTF platforms have taken it on the chin and recovered later.

A couple of days after going free, Schwab killed OneSource, it’s commission-free (NTF) ETF service.

We will no longer be marketing or promoting the program to our clients, and ETF sponsors will no longer compensate Schwab to participate in the commission-free ETF program.

Erin Montgomery, spokesperson, Schwab

Fallout

I was supposed to publish this when Schwab first went free, but boy am I glad that I didn’t. The fallout from Schwab’s move has created ripples across the financial services industry from other brokers to advisors, and it’s been fascinating to watch what unfolded. Schwab not only forced other brokers to go free but now it might be making a move that might spark consolidation in the broking industry. Last week, news broke that Schwab was in talks to buy TD Ameritrade for a reported $25 billion. The combined entity would have $5 trillion in client assets. Schwab and TD Ameritrade are also the second and third biggest RIA custodians serving over 11000 advisors which is where most of the action is given the higher revenue yields.

Here’s how the top custodians stack up:

Schwab holds roughly 50% of RIA custody market share, while TD Ameritrade holds about 15% to 20%, according to the analyst report. Major competitors are Pershing, which custodies about 750 RIAS with $734 billion in assets, and Fidelity, which custodies more than 3,000 RIAs, according to the companies (Fidelity does not break down assets by RIAs specifically).

Financial Planning

If the Schwab and TD deal does go through, E*Trade could be next?

Not just free trading, get paid to trade!

While everybody was busy going free, a new platform called All Of Us announced that it would pay people to trade. The company will share revenues from selling order flows and securities lending. How’s that for crazy?

Direct indexing

Schwab didn’t stop with just cutting commissions to zero. It also announced that it would start supporting fractional trading. It might seem like just another announcement, but this is a yugee deal. In the past decade, ETFs have seen some incredible growth in the US. Their transparency, tradability, and tax efficiency have made them incredibly popular among advisors and allocators alike.

But several smart people like Dave Nadig of ETF.com and few dumb ones like me have been wondering what comes after an ETF? Well, it could be the unwrapping of the ETF wrapper. Today, if you buy a Nifty 50 ETF or an S&P 500 ETF, you own all the stocks in the proportion of the index. You cannot customize it even if you wanted to, let’s say if you wanted to get rid of tech stocks because you think big tech is evil. If you had to do that, you would have to buy all the stocks in the S&P 500 in the proportion of the S&P 500 index. The problem is this is incredibly cumbersome and not many brokers support this and not to mention if you did this with whole shares, you need to richh!

But with Schwab allowing fractional trading, direct indexing becomes quite easy now. Before that, let me explain what direct indexing means. It is essentially like replicating a mutual fund or an ETF by individually owning the securities of an index with some customization in a separately managed account. Let’s say you want the S&P 500, but you have a huge ESOP in Google. You proportionally reduce the weighting and buy the remaining stocks. Similarly, you can express other views such as responsible or values-based investing such as getting rid of sin stocks, alcohol stocks, polluters etc. Direct indexing also makes security level tax-loss harvesting possible – selling loss-making securities and replacing them with similar stocks to offset gains and a whole lot of other fancy tax things that I am yet to grasp fully.

Now, Schwab is the second biggest RIA custodian. If it acquires TD Ameritrade, it will become a $2 trillion custodial giant with over 1000 advisors. Schwab could potentially kickstart the demise of ETFs and mutual funds by opening this up to advisors. Remember, RIAs control over $6 trillion in assets. People like Eric Balchunas posit that 90% of ETF flows are due to advisors. If they can make ETFs, they can make them less popular if not outright break them? Sounds too much like financial sci-fi? Moreover, direct indexing is not useful to everyone. For most small investors, an ETF is the best thing to have happened in the last 100 years.

If you want to understand more about direct indexing, this conversation with Brian Langstraat, the CEO of Parametric, the largest direct indexing provider managing over $200 billion is really awesome.

By the way, direct indexing isn’t possible in India because fractional share trading isn’t possible. However, my guess is that down the line, you will see platforms like smallcase essentially offer a version of imperfect direct indexing that allows you apply factor, ESG, tactical, and other overlays on broad indices like Nifty 100 or a 500. AMCs might offer close-ended funds to institutions who might demand such solutions. Because the Indian version of a separately managed account is a PMS and that comes with Rs 50 lakh minimum which put it out of reach for many investors.

How can they all be free?

Cash spreads

Trading fees are not the only source of revenues for these brokers; In fact, for Schwab, it just makes up 8% of its total revenues. Over half of the revenues in case of Schwab, TD, and E*Trade are from income earned on client funds or float income. When a client keeps idle cash with these brokers, they are swept into treasuries or money high yielding money market funds, and a small fraction of the income is passed on to the clients, and these brokers retain the rest. Unless investors specifically park their idle cash in a treasury fund or a money market fund, they pretty much earn nothing.

Selling order flows

In India, when you place an order from your trading account, it immediately hits the exchange. But in the US, brokers can sell order flows to market makers and make some money. Here’s how that works:

The way the market maker does this is by paying retail brokers to send it their order flow, and promising those brokers that it will execute their orders better than the public markets would. (This is called “price improvement,” and allows the retail brokers to fulfill their obligation to give their customers “best execution.”) So if a stock is quoted at $99.99 bid, $100.01 offered on the public exchanges, the market maker might buy it from retail customers for $99.991 or sell it to them at $100.009. (It’s not usually much price improvement.) It can offer a tighter spread than the public markets—and have money left over to pay the retail brokers—because it doesn’t have to worry about adverse selection.

Matt Levnie, Money Stuff

Interactive Brokers in its main paid offering doesn’t sell order flows. But IB Lite – the free offering will sell order flows to make some money. It’s a controversial topic, to say the least. The most common refrain is that people feel that they are being ripped off by big HFT firms, while brokers argue that they are offering better execution than public exchanges.

Schwab expects a quarterly revenue cut of $90 to $100 million, TD Ameritrade estimates a decrease of $220 million to $240 million while E-Trade estimates a quarterly revenue impact of $75 million. Will the possibility of higher cash balances and upselling offset the fall in revenues? Who knows.

Cash wars

The fallout from the move towards zero brokerage is that the focus has now shifted to cash balances. In India, we have a quarterly settlement mechanism. This regulation mandates that a broker has to transfer idle cash back to a client’s bank a/c if it remains idle. But in the US, this isn’t the case. The big brokers either have their own banking arms or are affiliated with banks. So, as broking revenues shrunk, income from client funds became a bigger source of revenues.

But startups are now taking aim at this. Betterment for a long time has been making noise about how brokers make a killing on idle cash balances. It also rolled out its own cash management program in July this year. Fidelity and Vanguard were also taking shots at other brokerages who weren’t defaulting cash balances into higher-yielding money market funds.

Fidelity took a rather aggressive tone about the interest rates paid by competitors in their cash sweeps in the press release when it went commission-free.

How about India?

Although it still charges for futures and options trades, Zerodha is the Indian equivalent of Robinhood. It made equity investments free, way back in 2015. Since then, it has gone on to become the largest broker in the country and one of the largest direct mutual fund platform. Later on, a few other firms like Upstox have aped its pricing model.

Just like Schwab once and Robinhood later on, Zerodha forced the big incumbent bank-owned brokerages like ICICI, Kotak, Axis, and other traditional brokers like Angel Broking and Edelweiss to offer discount broking like pricing models. Even Bajaj Finserv entered the broking fray recently with an unlimited annual pricing model. The operative word being “like”. Most of these pricing schemes have a ton of deceptive terms and conditions and hidden charges.

It also made investing in direct mutual funds free and forced a host of other platforms to follow suit. In direct plans, the seller does not earn anything. And to a large extent, SEBI has clamped down on under the table payments to direct mutual fund platforms. Earlier AMCs used to pay mutual fund platforms for preferential placement of funds, marketing activities, Singapore trips etc from their investor awareness program kitty. Yes, that’s correct, sending distributors on an all-expense trip to Thailand so that they can get a Thai massage was considered investor awareness. SEBI explicitly prohibited that in a circular in April 2019. Does this mean the practice has full stopped? Who knows.

Anyway, the big brokerages which still are stuck with legacy systems and % fee broking are in for a reckoning, which isn’t too far. We are already seeing signs of this. Sharekhan in September laid-off over 400 employees. ICICI Securities announced its results recently and here’s a particularly telling excerpt from an ET article:

The company said it remains committed to pursuing cost efficiency by undertaking a number of initiatives like “centralising certain verticals to optimise infra and manpower cost, process re-engineering, harnessing group synergies, and migrating to digital/low touch coverage model”.

This is just fancy speak for “we are going to reduce costs and fire some employees.” Indian broking will inevitably see consolidation with the likes Paytm, Groww who have deeper pockets entering the broking space. Regardless of whether they are serious or competent enough to pull off broking, which is a billion times more regulated than mutual funds, they’ll burn money, and that means the lazy incumbents have a date with destiny soon. New competition aside, the next bear market should be fun for these guys because bull markets tend to mask a lot of things.

Asset management

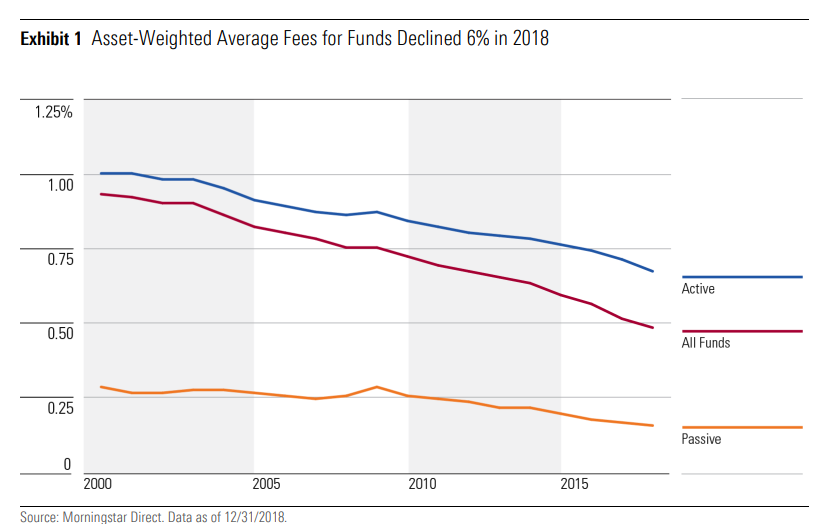

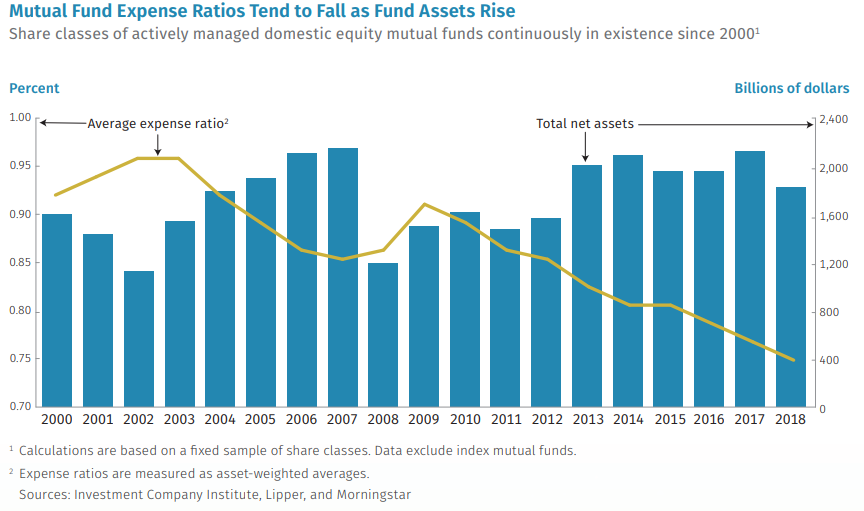

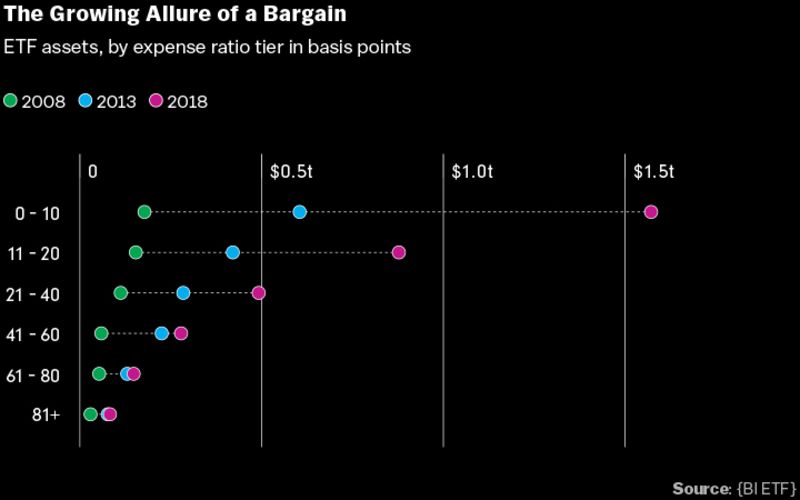

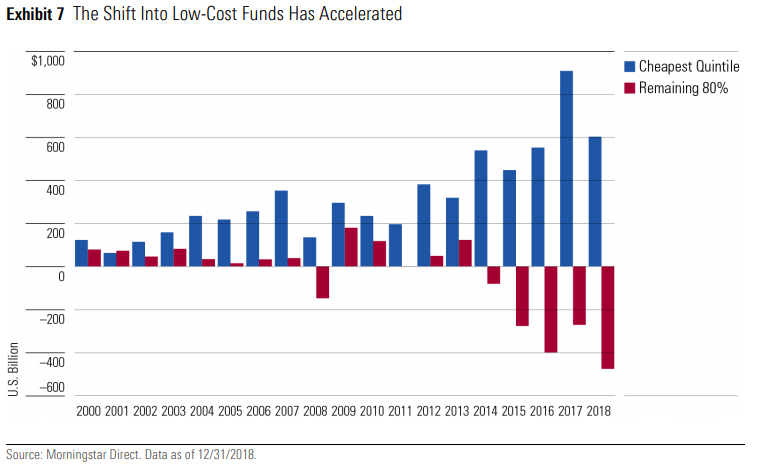

If you thought, the price wars among online brokerage were brutal then you ain’t seen nothing. Since the 2008 global financial crisis, asset management companies have been caught in a far more brutal price war. Rise of passive, increasing cost awareness, and the increasing influence of advisors have been a few key factors responsible for the drastic fall in expense ratios across the board.

But one of the single most important factors for the fall in expense ratios has been Vanguard, which now manages over $5 trillion in assets. Vanguard has been so influential in slashing expenses and forcing other asset managers to follow suit, that the term “Vanguard effect“, was coined.

The asset-weighted average expense ratio has fallen every year since 2000. Investors are paying roughly half as much to own funds as they were in the year 2000, when the asset-weighted average fee stood at 0.93%; they’re paying 40% less than they did a decade ago and about 26% less than they did five years ago.

Morningstar U.S. Fund Fee Study.

2008 was nothing short of a landmark year. The trend in falling fees accelerated while passive assets picked up dramatically. It seems like people finally realized that all those fancy costly funds were largely useless. I’d say 2008 was the year when the importance of costs firmly took hold in investors minds and advisors played a huge role in this.

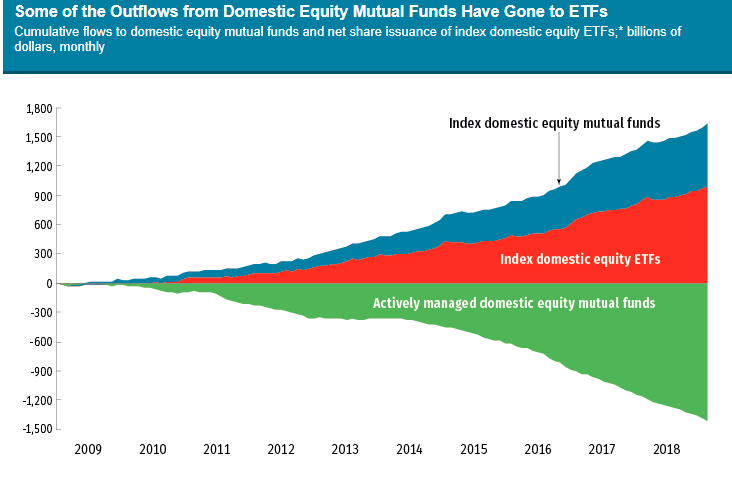

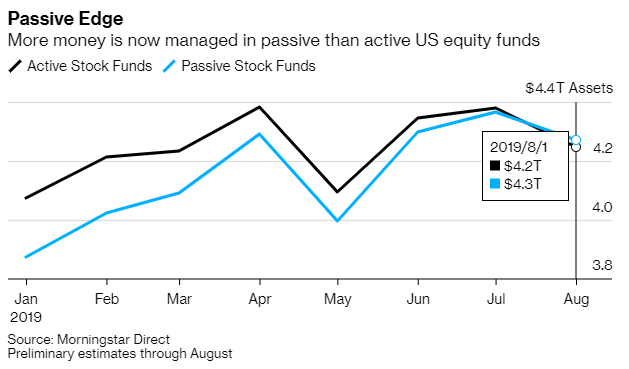

All in all, since 2008, over $1.4 trillion has flown out of active mutual funds while over $1.6 trillion has flown in passive index funds and ETFs.

Where has the money flown to?

Dirt cheap funds are attracting a disproportionate chunk of the flows. These cheap funds, most often than not, are from Vanguard or iShares. To put that into perspective, the cheapest 10% of funds attracted 97% of all flows in 2018.

That’s the broader landscape. Just like the Indian asset management, assets are heavily concentrated among the top 5 asset managers. Life outside the top five asset managers is increasingly brutal. Smaller ETF issuers find it increasingly difficult to garner assets because over 80-90% of the flows are going to cheap beta products and big custodians make life difficult for them to distribute funds, courtesy of the NTF platforms.

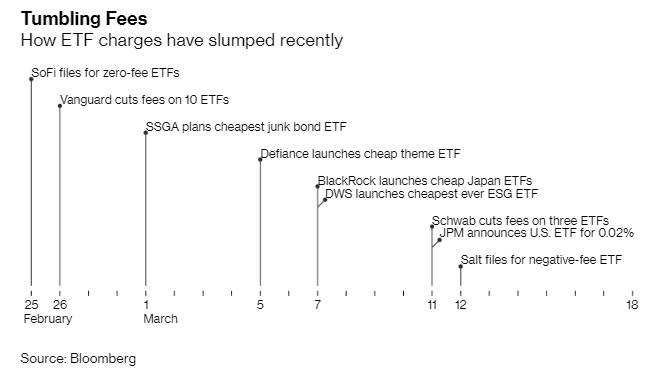

Just to give you an idea of how brutal life is for the asset managers, there was a sudden outbreak in the fee war during February and April of this year.

In a span of a couple of months, we saw zero expense ratio and a negative expense ratio ETFs. These ETFs didn’t really find any acceptance for a host of reasons, chief among them being distribution. Meaning, these ETFs aren’t available on the NTF platforms like I’ve explained above. Pay to play agreements have made life extremely hard for small ETF issuers. More so given that the large shadow cast by iShares, Vanguard, and State Street who are just vacuuming over 80% of the flows. But small niche and boutique ETF issuers seem to have caught a break with brokerage fees now at zero. The older fee arrangement for preferential distribution of ETFs no longer makes sense.

Here’s Ryan Kirlin, head of capital markets at Alpha Architect – a boutique firm that offers factor oriented ETFs. I’m a huge fan of the crew, and they publish some amazing content.

The combination of an intolerant minority and the huge upfront cost of the “commission-free” platforms made this a fairly significant hurdle for many ETF companies by making the rich companies richer and limiting the smaller players ability to gain traction. The removal of the small commissions to buy and sell ETFs will have a much larger effect for boutique ETF companies than it may appear.

Fee wars in India

The Indian mutual fund industry is yet to see a widespread fee war like the US. Expense ratios have been slowly grinding down in India largely because of a push by SEBI. After SEBI revised the expense ratio slabs last year, there was a meaningful decrease in expenses across funds. But they are still high by global standards because distributors account for a vast majority of investments. Even though SEBI mandated AMCs to offer direct plans of all mutual funds, they haven’t really caught on. Even at an industry level, just about 18% of the total AUM is in direct plans. Institutions and HNI investors make for a large chunk of the direct AUM.

Morningstar publishes a bi-annual study called the Global Investor Experience study (GIE). It analyses the competitiveness of fund expenses, taxation, regulations, disclosures etc. across 26 countries and grades them. Here’s are some excerpts from this year’s study:

India had been amongst the most expensive geographies when it comes to expense

Morningstar GIE

ratios, especially for equity and allocation funds. With the recent expense cap reductions, India has seen a meaningful decrease in asset-weighted medians in this study.

Assets in direct share classes have been rising gradually among investors who have partnered with fee-based advisers. Still, the majority of individual investors seek the services of mutual fund distributors and thus invest through a commission embedded plan, resulting in India’s relatively higher asset-weighted medians. Taken separately, the medians considering only distributor plans come in higher than the overall medians, while the medians for direct plans are more competitive globally. –

Although the industry AUM at 26 lakh crores might seem big, there are just under 2 crore unique mutual fund investors in India. Also, there are just a handful of fee-only advisors in India. I’d probably put the number at less than 100. Hopefully, as the markets mature and investors along with it, cost consciousness among investors increases, expense ratios should grind down.

But in the long run, if expense ratios have to come down advisors (RIAs) are the key. But on a sidenote, Indian index funds are as cheap the US funds. Today, a Nifty Index fund and ETFs are available for fees as low as 0.05%. And given the dismal performance of most active funds, investors are better off with low-cost index funds. But ETFs are a novelty in India. I love ETFs, but I am bearish on their adoption at least in the near future, and I’ll write why, in a separate post.

Read: Why you should shut up and invest in low-cost index funds.

The next battleground?

The US asset management industry has been in the grip of an intense fee war for well over a decade now. Like I wrote above, today you can invest without paying anything, in fact, you can technically get paid for investing. While expense ratios have hit historic lows, investment advisory fees have remained relatively stable. Cost compression in asset management seems to be reaching its limits.

Advice is the next battleground for all these companies and the battle is already heating up. Financial advisor Rick Ferri sums it up rather succinctly:

The US asset management industry has been in the grip of an intense fee war for well over a decade now. Like I wrote above, today you can invest without paying anything; in fact, you can technically get paid for investing. While expense ratios have hit historic lows, investment advisory fees have remained relatively stable. Cost compression in asset management seems to be reaching its limits.

Advice is the next battleground for all these companies, and the battle is already heating up. Financial advisor Rick Ferri sums it up rather succinctly:

“Adviser fees are the last bastion of gluttony in the investment industry.”

Although it’s easy to say that a US advisor charges 1% on an average, there a little for nuance to this. Luckily, Micheal Kitces had published an analysis of the all-in advisory fee by portfolio sizes. “All-in fees” include the advisor’s fee, the expense ratio of the funds, transaction costs, platform fees, and other charges.

The median all-in cost of a financial advisor serving under-$250k portfolios was actually 1.85%, dropping to 1.75% for portfolios up to $500k, 1.65% up to $1M, and 1.5% for portfolios over $1M, dropping to $1.4% over $2M, 1.3% over $3M, and 1.2% over $5M.

From this FT article:

Fee compression is happening in the supply chain pretty extensively, but not in the advisory fee level,” Mr Garcia says. “The reality is we’ve seen tremendous price stability and even pricing power in the adviser fee-only advice model.” The average yield on assets, fees charged by advisers on dollars managed, was steady at a range of 0.72 per cent to 0.77 per cent in the period from 2005 to 2015, according to Pershing data. The average yield then dropped from 0.72 per cent in 2016 to 0.69 per cent in 2017.

Micheal Kitces in this podcast also confirms the revenue yield range. So, how have advisors managed to keep their fees steady? By increasingly shifting assets from high-cost active funds to low-cost funds – be it passive or smart-beta (a disgusting term).

When robo-advisors cropped up on the scene, “experts” and “analysts” predicted that they would make human advisors obsolete. But in reality, robos have only largely managed to fulfil the investment management function rather than comprehensive financial planning. That is offer low-cost asset allocation portfolios. They haven’t been able to offer comprehensive financial planning functions such as tax planning, estate planning, insurance etc. Micheal Kitces aptly summarised this way back in 2012 when robos really started popping on the scene.

The simple reason why robo advisors are no threat to real advisors is that the services they offer are nothing like the comprehensive financial planning process offered by a true financial planner. For better and for worse, the low cost offering of at least the current suite of robo advisors generally begins and ends with setting an asset allocation. In other words, they’re not actually financial advisors at all. They’re investment advisers; in fact, most of them are actually RIAs simply operating a basic assets-under-management asset gathering business model (yet, ironically, despite being an RIA, Betterment suggest that (Registered) Investment Advisors charge “An arm and a leg” and only allow clients access to their own money “with a fight”).

Because of their simplified business model, none of the robo advisors are currently prepared to offer personalized, individual advice on retirement, college education, estate, tax, or insurance issues, nor even to help with the basic budgeting and cash flow planning. They provide a diversified, passive, strategic portfolio and rebalance it. Period.

Robos have also been subject to the vagaries of costs. Several robos have shut down or have been acquired. Being a pureplay robo is extremely hard unless you can quickly build scale, given the razor-thin margins. Other robos, instead of replacing human advisors have co-opted them. Robos like Betterment, SoFi, and Kindur offer access to human advisors for an extra fee. In fact, the irony of robos is that advisors who have high minimums often refer clients to use robos. Wealtfront launched a much-maligned risk parity fund with high fees to make some money which quite didn’t work out as well as hoped, and the CEO even admits it.

Distribution is the life force of asset management

A slight aside here. Without distribution, most asset managers are dead in the water. Not wanting to miss out on the party, asset managers are encroaching on the space of advisers. Today, most of the major asset managers have some sort of an advisory play. This is either in the form of a pureplay robo advisory, hybrid robos, or through investments and partnerships.

Here are the top robos:

Vanguard and Schwab have been the successful of the lot among asset managers platform. Vanguard’s hybrid advisory platform (CFAs+tech) has over $140 billion under management. While most people label Vanguard PAS as a robo it is not. Schwab’s hybrid robo (Schwab robo Intelligent Portfolios+CFAs) has over $40 billion under management. Schwab also created, as it is in its DNA, created somewhat of a flutter when it announced the launch of a subscription-based financial service while making it robo offering free. It used to charge a 0.28% fee earlier.

Blackrock, the other giant acquired FutureAdvisor in the US while investing in Scalable Capital, a robo focused on the European market. Invesco acquired Jemstep in 2016. The interesting thing about Jemstep is that it is a B2B service or a white-labelled service that allows RIAs, banks etc. to offer their own digital advice solutions. Fidelity offers a robo called Fidelity Go, while active giant T Rowe offers ActivePlus Portfolios.

Vangaurding

Vanguard has explicitly stated its intent to drive down the cost of advice:

We’re here to help clients, whether they come directly to Vanguard or through an advisor. If we can lower the cost of advice, we’ll do that.

Tim Buckley, CEO, Vanguard speaking to ETF.com

I can’t imagine anything but the price (for advice) coming down

Tim Buckley on The Long View podcast

Vanguard Personal Advisor Services at 0.35% is one of the cheapest investment advisory services. But now it wants to go after the pureplay robos. A recent filing showed that Vanguard is planning to launch a pure robo solution targetted towards at the masses at just 0.15%. Betterment and Wealthfron, the two leading robos charge 0.25%. So, the robos will be Vanguarded for sure. Getting to the topic of human advisory fees now.

Future of the traditional AUM fee

There are people who believe that advisory fees have nowhere except down while others believe that won’t be the case. Micheal Kitces, in this podcast cites data that advisors are adding more value to retain the fee they earn rather than reduce fee. This is also apparently borne in the fact that the profit margins of advisory firms have been reducing while the market has been on a tear lifting up AUMs. On the other hand, you have people like Cullen Roche:

So, what do I think will happen over time as this reality seeps out into the public?

- There will be a sweeping change in fee structures as the 1% fee structure comes under attack as clients realize they’re paying an AUM fee structure for advisors who aren’t really portfolio managers.

- Flat fees will become increasingly common as advisors who are putting together indexing strategies are induced to move away from the AUM structure to a flat fee structure that is more similar to the way accountants and consultants charge fees.

This is going to be life and death for many advisors. Legacy firms with massive overhead and fixed high fee AUM structures will struggle to compete with the coming change in fee structures. Firms that are able to move to a leaner and more tech based platform will outperform as they make up for lost revenue with fatter margins.

But maybe what plays out will be somewhat between these two divergent views. But the % of AUM fee won’t retain it’s dominance forever. We are already seeing the emergence of alternative fee models such as flat-fee, hourly and other hybrid fee models etc.

But having said that I have to agree with Micheal Kitces. The AUM fee model is brutally efficient because the client doesn’t realize what he is paying. And as the markets grow and the AUM increases, the advisor automatically makes more, it’s a powerful motivator for the advisor to stick to it. On the other hand in a flat-fee model, if you have to talk to a client in order to increase the fee after a couple of years, chances are he would terminate the engagement because he feels the pinch even if the flat-fee pricing would have been ultimately much cheaper.

Not to mention the ease of payment. In an AUM model, the fee is automatically deducted and clients, for the most part, don’t realize it. But in a flat-fee model, a client has to explicitly write a cheque which any day will fall short of an AUM fee model in terms of convenience. But an AUM fee model won’t work for all investors. AUM fee model typically makes sense only for clients with larger account sizes. Then there are a variety of investors ranging from DIYers to people who just need an opinion on their portfolios to total delegators. Which means these alternate fee models will grow over a period of time to become much more dominant.

On the other end, all the so-called advisors who were just recommending a bunch of funds doing nothing else will go extinct. Investors, if not everyone, at least a good chunk of them, as they become cost-aware, will move to models that make financial sense to them. Ultimately unless advisors deliver increasing value, they won’t be able to command the same revenue yields and profit margins forever.

How about India?

The advisory ecosystem in India is seriously lacking. This is evident in the fact that just 18% of the total mutual funds AUM is direct plans (0 commission plans). And also there are just about 1263 RIA registrations on the SEBI website. A vast majority of these RIAs are also mutual fund distributors and stock tipsters. So, you only have less than a handful of fee-based RIAs in India. Not that all distributors are bad, but 1% commission year on year for just a couple of mutual fund recommendations, which is what most distributors do? That’s as big a scam as any.

Another problem is the friction of payments. In a regular plan of a mutual fund, a vast majority of the investors don’t realize they are paying anything and a big chunk of them even think that they are free. Even if people realize, they may not care given that they don’t have to do anything because the commission is automatically deducted. This doesn’t hurt as much as having to write a cheque or make a transfer to an advisor every year, even if the amount paid to a fee-only planner is lesser. So, until and unless a seamless recurring payment system comes up, this is will a road bump that might slow down the move toward independent RIAs.

And then there’s the banking channel – the most scammiest and dangerous distribution channel of all. Crores of Indian have been scammed into buying sub-par investment and insurance products that are designed to do one thing and one thing only – make the sales guy and the bank rich.

I came across a paper recently which quantified the losses Indian investors have faced dues to mis-selling of insurance and mutual funds. The number is an astounding Rs 1,98,450 crores just between 2005 and 2012.

Investors lost upto US $28 billion (Rs 1,96,000 crores) to mis-selling of unit linked insurance products between 2005 and 2012. Similarly, Anagol and Kim (2012) estimate losses of US $350 million (Rs 2450 crores) from shrouding of fees by Indian mutual funds.

Misled and Mis-Sold: Financial Misbehaviour in Retail Banks?

The number will be far higher if calculated till 2019 given the Indian markets began a major bull run in 2013. And then there are PMSs, AIFs, fraudulent unregistered advisories, LIC agents which have also caused irreparable damage to investors. I am not painting everyone with the same brush, and of course, there will always be exceptions.

But having said that, this is how most markets around the world evolve, that’s the sad reality. You might think that the US, given that it is the biggest financial market in the world, is transparent and clean but that’s not the case. Before the rise of independent RIAs, brokers were dominant in the US, and there was rampant mis-selling, and it still exists to this day but not as much as say the early 2000s.

But all said and done; we just have 1.98 crore unique mutual fund investors in India. That number has to increase if we are to see more fiduciary advisors.

Great read. I have one suggestion.

Pick one actively managed high AUM fund. Calculate the commission paid by an investor in a regular fund vs direct one for an SIP amount of Rs 10,000 for one year. Let the investor himself realize the amount of money he has paid as commission, knowingly or otherwise.

This data would be helpful for flat-fee based RIAs to drive their point. Thanks.