This post has been in the cold storage for a while now. This isn’t a blogpost in the strictest sense but rather my incoherent thoughts on the subject of advice. I intend to keep this as a live post and keep updating it as and when I think there’s some new thought worth sharing. Being a low IQ person, it takes a lot of time to process, hence this.

The initial reason I wanted to write this post was a phrase that even you would have uttered many a time. Remember that phrase we utter when someone asks for financial advice. “Go talk to a registered investment advisor”. I’ve also said this a hundred times. I mean, it’s the right thing and the easiest thing to do. You don’t want to give some random piece of financial advice to someone when you aren’t qualified enough. You may very well fuck up a person’s life! I don’t know about you, but I had never thought if India had enough qualified people to give proper advice.

I tweeted this poll on twitter a few months apart to get a sense of how people invested.

This isn’t a representative sample but gives some sense as to how Indians invest. But since I started writing this post, a lot has happened. There have been a series of debt defaults which have rocked debt mutual funds, Yes Bank had to be bailed out, and the Indian markets are in the midst of the sharpest correction since 2008. And when the markets fall, and things are in flux, a lot of salacious stories come out. Like this one, for example, former Indian national cricketer, Manoj Tiwari seems to have been a victim of mis-buying/mis-selling but more on that later.

As I started writing this post, I realized, I cannot just write about how Indians invest and how they get their advice, there has to be more to it.

So, here we go again and fair warning, this will be looooong! So, close Netflix, Hotstar and you incognito tab with Your p****

There has never been a better time to be an investor, and at the same time, there has never been a worse to be an investor. Maybe there was a worse time, I don’t know, bugger it! Today, investing is free, and even advice is free. There is no shortage of investing advice. There’s a deluge of free advice today. Deluge you say? Yes, a deluge. Ok, let me list some things out before I throw my customary silly and juvenile hissy fit.

But good investing advice is increasingly becoming a rarity, and that’s where a good advisor comes into play. But before I talk about whether India has enough qualified advisors, here are all the players and platforms that offer some form of investing advice or are involved in business of relieving your money from you.

Mutual fund platforms. #Mutualfundssahi hai?!

Let’s start with my favourite – mutual funds. This is a case of recommendations porn. Every single platform has salaciously worded categories such as “Best Large Cap Funds”, “High Performing Mid Cap Funds”, “High Risk for High Returns” and other asinine labels. Open any app, and you will see hundreds of recommendations. But bar one or two, none of the platforms explain what the categories mean, how the funds were chosen, and how their picks have fared historically vs benchmarks.

I mean, why would they? Like I wrote in my previous post, which pissed off a lot of people, almost all of the major mutual fund platforms are funded by VCs. And as is a rich tradition, you need to cook up some numbers to show them, and if there’s no AUM, you just make up a number.

So, how do you get your AUM up?

Step 1: Go direct because scamming people into costly regular funds online isn’t viable anymore. Just ask Scripbox and FundsIndia how hard it is.

Step 2: Come up with a retarded tag line, you know who I am talking about But this step is optional.

Step 3: Launch an app and just fill the screen with recommendations. It’s recommended that you use labels like “Best”, “High performing”, “Top-performing”, and so on because they make perfect sense and they are not retarded at all. Silly notifications to round it all up.

Step 4: Advertise during cricket matches and women’s kabaddi matches. Because you always make decisions about investing your hard-earned life savings during a cricket match ogling at cheerleaders, right?

Step 5: Spout random numbers because AMFI and SEBI don’t publish platform wise AUM numbers. So, if you say, you facilitate 1000cr of investments a day, who the hell can verify that number? You can even claim that you facilitate the entire industry’s Rs 8500cr odd SIP book yourself. Hey, go big or go home! Added bonus if you creatively make up numbers.

Look, choosing a fund, in the grand scheme of things isn’t all that important. What really matters is if the clients are investing for the right reasons and the right way. Most importantly, in my view, what makes all the difference in investing outcomes is the behaviour of the client.

You’d think that these platforms would do a decent job of recommending funds at least, but they’ve fucked up in some hilarious ways.

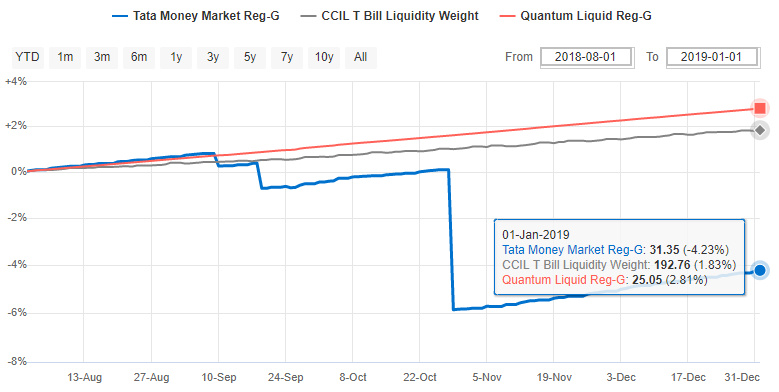

Fuck up 1: This was when the IL&FS shit hit the fan. A certain new direct mutual funds platform had recommended Tata Money Market Fund as Better Than FD. Here’s how better it was. It lost almost a year’s returns in a span of a month. This was a 5-star fund by VR and others. And that certain platform just replaced that fund, no fuss, no muss, no explanation!

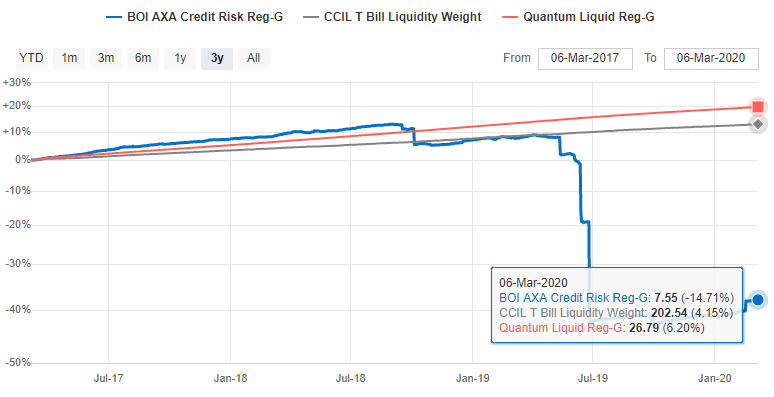

Fuck up 2: BOI AXA Credit Risk Fund. This one is even crazier and the fund lost 50% since September 2018. It even fell 26% in a single day. This fund was also heavily recommended and was rated 5 stars by Value Research, even after it fell 26%.

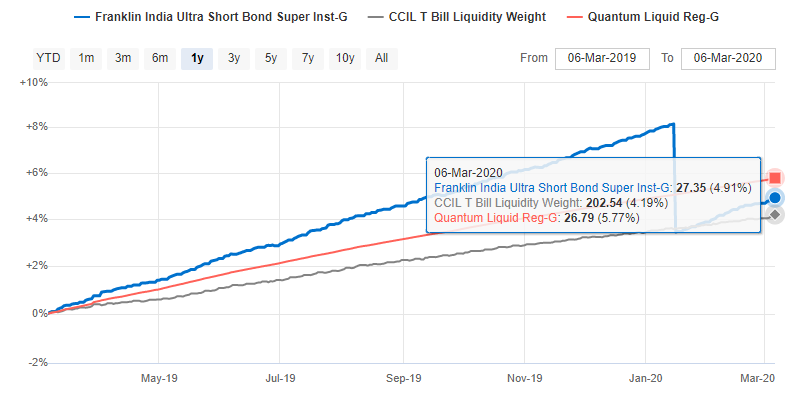

Franklin Ultra Short fund was recommended by pretty much every mutual fund platform out there. The fund fell 5% in a single day after it had to mark down it’s Vodafone exposure. A lot of people had highlighted the fund it was taking but hey, when has sensible advice ever caught attention. It’s the category topping returns and the 5-star ratings that matter.

These are just a few, and there are countless others. According to CAMS, half of the investors who started investing in FY19 are Millenials. This is a generation that hasn’t seen a market crash. Now, do you think all these investors who follow the recommendations of platforms stay invested when the proverbial shit hits the fan, and it looks it’s already hitting? Hell no!

They will redeem their investments like it was a bank run and leave the markets to never return. In my opinion, a mutual fund platform should either stick to JUST execution or do FULL and holistic advisory. Today, except for a couple of big platforms, all of the platforms do half-assed advisory. In my view, platforms should have a build a relationship and grow with the client as his wealth grows attitude. But none of the platforms, the way I see it, have this.

The real investors don’t invest in mutual funds for 2-3 years, they invest for decades, and mutual fund platforms should not only sell funds but foster good investing behavior, figure out ways to helps clients stay their course client during rough market phases and help them build wealth over the years and decades.

But all mutual funds are in a dumb rat race to cook up dumbass numbers to show their investors! And I’m open to bets that none of these platforms have even a remote shot at survival in the current avatar.

Mutual fund distributors

These guys are also known as Independent financial advisors (IFAs), I don’t know how the term came to be, but it is very misleading. Because there is nothing independent about some of them. Thankfully, SEBI has published a guideline saying that if someone is distributing mutual funds, he or she cannot call himself or herself as an advisor, unless they are registered as a Registered Investment Advisor (RIA).

Person dealing in distribution of securities shall not use the nomenclature independent financial adviser (IFA) or wealth adviser or any other similar name, unless registered with SEBI as IA.

Of course, like all things you cannot paint everyone with the same brush. There are some good distributors who genuinely care about their clients, and I know some of them. But the incentives in this model are fundamentally misaligned. A distributor earns commissions for as long as you invest and his or her natural inclination will be to sell you mutual funds that earn the highest commission and churn funds so that the commissions don’t drop. 82% of the total individual industry AUM is in regular plans.

Mutual fund distributors are legendary for mis-selling two funds – Fixed Maturity Plans (FMPs) and Balanced Funds. FMPs are close-ended funds with a fixed maturity. For example, if you invest in the ICICI Series 1 1825 days Debt FMP, your money will be locked in for 5 years until the maturity of the FMP. Well, FMPs are also listed on the exchanges, and you can technically exit prematurely by selling them but hardly a handful of the FMPs trade.

FMP is a beautiful structure. Theoretically, it’s supposed to encourage good behaviour among investors because of the lock-in, but for the AMCs, these are meant for asset gathering. Close ended funds have been rampantly mis-sold with distributors earning upfront commissions as high as 6-8% in some cases. Debt FMPs are sold like vegetables as a replacement to fixed deposits, but some of the AMCs have done a piss-poor job of managing them. These funds were filled with low-grade bonds from IL&FS, DHFL, Essel (Zee Entertainment) Kwality among other stellar names. And once IL&FS blew up, plenty of debt FMPs saw double-digit NAV falls.

Balanced funds, on the other hand, were heavily mis-sold as guaranteed dividend products. Dividend in a mutual is in itself a misleading term because mutual funds don’t offer dividends. What the AMCs do is sell holdings and give your money back. Unwitting investors fell for the regular dividend pitch hook line and sinker because distributors promised them 8-10% dividends. This is not just mis-selling but morally reprehensible.

AMCs

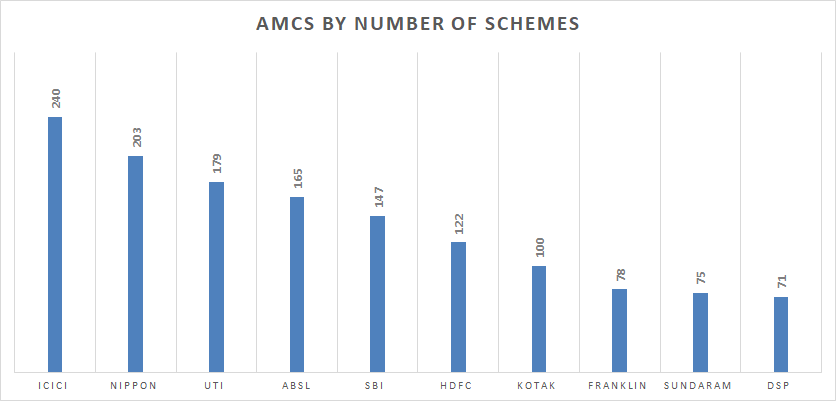

While AMCs don’t mis-sell as much as the rest of the other stalwarts, they are guilty of mis-launching and mis-management. Well, AMCs are in the business of gathering AUM and you can’t really blame them, but Indian AMCs have taken this a little too far given how shallow our markets are. I mean in equities, all AMCs pretty much stick to the top 500 stocks. Here are the AMCs with the most number of schemes.

This includes both open ended and close ended schemes. If somebody lands on the ICICI Pru website, pretty sure they’ll close the site and invest in an FD.

Luckily SEBI in its recategorization exercise imposed a restriction of only one scheme per category except for thematic, index funds, and fund of funds (FOFs). And AMCs have taken advantage of this loophole. The recent surge in the filings and launches of index funds is probably due to this rather than AMCs wanting to offer low-cost products.

And then there’s the issue closet indexing. Charging 2% to deliver index-like returns is just daylight robbery!

A wise man once said, most Indian mutual funds are

80% beta and 20% bullshit

Wise man

When you invest in an active fund, you are paying the manager to beat the benchmark. But some Indian AMCs are notorious for hugging benchmarks, and this shows up in the numbers with over 50% of the managers failing to beat them at any given point of time.

No career risk, no alpha. But as long as investor remain oblivious about costs and performance, AMCs and distributors will gladly take advantage of this. And if investors don’t care, the managers don’t have to do much; they can hug and kiss the benchmarks, gather AUM, and still make their bonuses.

I recently tweeted this after the mutual fund houses had to write off over Rs 2000 crores worth of Yes Bank AT-1 bonds after RBI said they are worthless.

But the problem in debt mutual funds had started way before this fiasco. The credit events post the IL&FS crisis laid bare the ineptitude of several top AMCs like UTI, Nippon, Franklin, and Birla when it comes to managing debt. What’s shocking is that UTI Mutual Fund had exposure to almost all the companies that have defaulted since the IL&FS crisis. I mean, how does one achieve that? Unlike equities, where a company’s stock price may recover post a fall, losses from debt default are almost always permanent. Ironically, these funds were marketed as better than FDs.

Frequently tinkering with expense ratios, the processes, the philosophies, and then there’s the issue of silly labelling. What the hell is a PHD fund? It’s shenanigans all around.

Banks

Banks are hotbeds of mis-selling. I don’t think banks have ever sold a product in an honest manner since the concept of banking was invented. The incentives for bank managers are sales driven are fundamentally misaligned. They are worse than insurance agents when it comes to mis-selling. There are probably lakhs of people who’ve walked into a bank to buy an ELSS mutual fund and have instead come out unknowingly with ULIPs.

A relative of mine walked into Kotak bank to close a demat account and came out with an endowment policy in exchange for reducing unpaid AMC charges for a few years. That’s how brilliant the selling is.

A research paper by Renuka Sane and Monica Halan on mis-selling in banks tried to quantify the damage. Here’s a startling number:

Halan, Sane, and Thomas (2014) show that investors lost upto US $28 billion (Rs 1,96,000 crores) to mis-selling of unit linked insurance products between 2005 and 2012. Similarly, Anagol and Kim (2012) estimate losses of US $350 million from shrouding of fees by Indian mutual funds. A fall out of this is the erosion, not only of financial wealth, but also of trust which can damage participation in financial markets

That’s just till 2014 and the number will be far higher if we include the subsequent years given that ULIPs and hybrid mutual funds became a lot popular due to tax arbitrage and the subsequent mis-selling by banks and distributors highlighting the fact.

It’s not just mutual funds or insurance. Name any high commission product, and these guys will mis-sell the hell out of it. The implosion of Yes Bank brought one such case to the fore. Yes Bank AT-1 bonds which are now worthless were heavily mis-sold as replacements to the bank’s own FDs. Coupons of 9%+ were offered and ideally that itself should have been a red flag, but the sad reality is that there are a lot of unwitting investors. These people place a lot of undue faith in bank RMs to do right by them. It’s just heart-wrenching to see tales of retirees losing their life long savings because of mis-selling.

The wealth management divisions of these banks also hawk AIFs, PMSs and other high-fee structured products to wealthy HNIs like vegetables. Mis-selling cuts across income brackets

But it is also important to ask, why are banks so good at this. I was having this discussion with a friend of mine, and he said banks have figured out how to take advantage of people’s trust in them perfectly. Think about it, of all the financial entities we interact in our lives, we trust banks the most, and with good reason. Large banks have rarely gone under. If there’s trouble, RBI usually steps and arranges shotgun weddings like GTB with OBC, roping in SBI and others to bail out Yes Bank, imposing restrictions on PMC Bank while not allowing it to go under, etc. The research paper by Renuka Sane and Monica Halan comes to a similar conclusion:

A 2013 Gallup Poll showed that 70 percent of the Indians polled said they trusted banks. The answer was 13 percent for Greece, 27 percent for the UK and 37 percent for the USA.5 Banks, when they discharge their basic function, that of holding money safe and giving a small return on deposits are trusted as instances of large public and private sector banks going bankrupt and hurting depositors are unheard of in India. It is this trust in the basic banking function that is carried over when buying third party products such as mutual funds and insurance.

Banks are tremendously skilled at arbitraging the gap between trust placed by consumers in them and the trust they deserve. It shows up in the numbers too. Of the top 10 mutual fund distributors by commissions earned, 6 are banks.

| NJ IndiaInvest Pvt Ltd | 807.67 Cr |

| Axis Bank Limited | 555.63 Cr |

| HDFC Bank Limited | 496.67 Cr |

| State Bank of India | 487.58 Cr |

| ICICI Bank Limited | 355.26 Cr |

| ICICI Securities Limited | 318.85 Cr |

| Kotak Mahindra Bank Limited | 255.01 Cr |

| Prudent Corporate Advisory Services Ltd | 234.72 Cr |

| Citibank N.A | 181.85 Cr |

| IIFL Wealth Management Limited | 176.11 Cr |

Iska target kya hai?

If you thought that MF advice was bad, stock advice gets badder and has a particularly nasty stench.

Right around 2014, when the whole Modi rally started, I used to be part of these WhatsApp and Telegram groups. This was an experience like no other. Partly because it was so damn instructive about human greed, especially the naive kind.

The markets, especially mid and small-caps, began a massive rally starting May-June 14. This was one of those everything goes up markets. Stocks, both good and junk, started rallying. All you had to do was to randomly pick a basket of mid and small-caps and odds were you would have made money.

Indian tipsters and operators have always been ingenious. During this period, they discovered that with WhatsApp, Telegram and Facebook groups, they had an ever-expanding audience of chumps to pump and dump stocks.

This was the time when the term “multi-bagger” became mainstream. Every mid and small-cap stock was touted as the next Apple, Microsoft, Google, and whatnot.

“Iska target kya he” pretty much summed up the mood of this time period. Every stock that has today destroyed wealth was pumped up during this time. Sintex, Vakrangee, PC Jeweller, Gitanjali Gems, Venkys, Cupid, Lovable Lingerie, and countless other stocks. Someone decided to create a thread on Twitter with such gems. The thread is a bit old, and the stocks have seen further double-digit falls.

About five years since the pump, these stocks have destroyed the fortunes of countless retail investors. The operators who jacked up the prices have long since exited leaving retail investors holding bags of steaming piles of shit. Who knows how many people would have ploughed their retirement savings into these stocks.

Predictably, all this ended very badly. Since the peak in Jan 2018, here’s how the mid and small-cap indices have fared.

But the indices don’t show everything. There has been nothing short of a bloodbath. All the scammy stocks that were pumped have become single-digit stocks from the high double and triple digits.

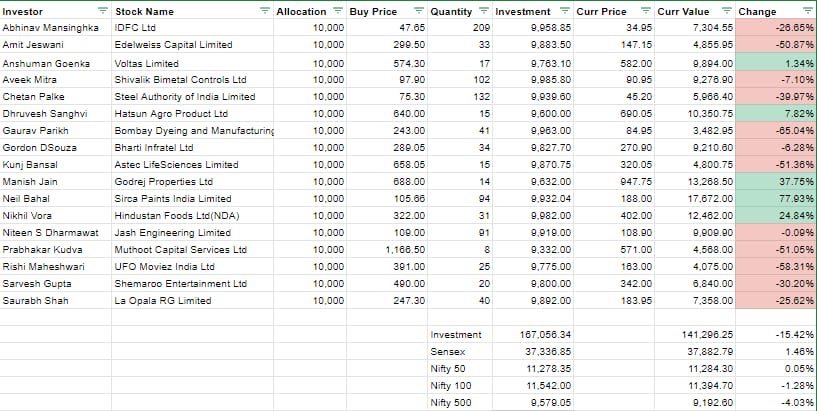

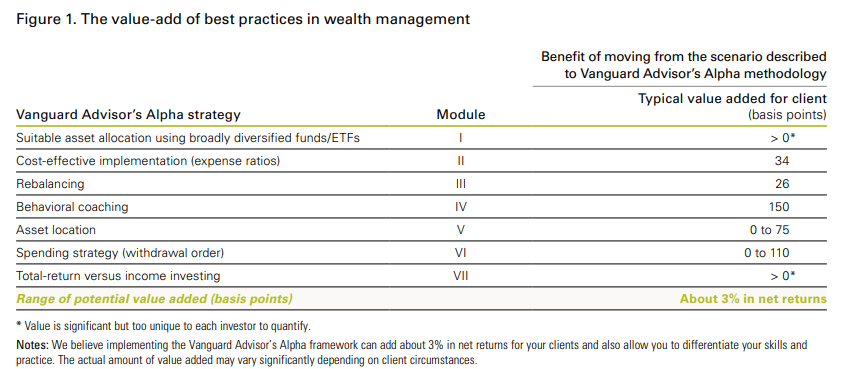

Retail investors have as much a chance at picking good as monkeys do. No, I’m serious, here’s the data. Not just common retailers, even the famed titans, are having a hard time. Here’s how the stock picks some pretty smart people have fared since the last alpha ideas 20:20 meet.

Even legendary hedge fund titans are closing down their funds

Porinju, the famed portfolio manager’s travails are telling. When the Modi rally started, he was a genius. But when the bubble popped, he started blaming the Govt and what not. He even goes as far as to say that liquidating the portfolio might be tough. He mainly trafficked in mid and small-cap names which are notoriously illiquid.

If the smartest of the bunch cannot get it right, what chance do we retail investors stand? So, realizing one’s ability and investing according is very important!

Indore

Nagpur is famous for Oranges and Indore is famous for tipsters. Owing to the availability of cheap labour, Indore has become a hotbed of tipsters. Thousands of tipsters have set up shop there and given that they can hire call centre’s pretty cheaply.

These words have become eponymous:

Sir, apki trading kaisa chal raha hai

They call up unwitting traders and investors and sell them trading tips by touting ridiculous success rates. And this all ends predictably with people losing their money. This ET Prime story explains the modus operandi and was published after several advisories were banned by SEBI.

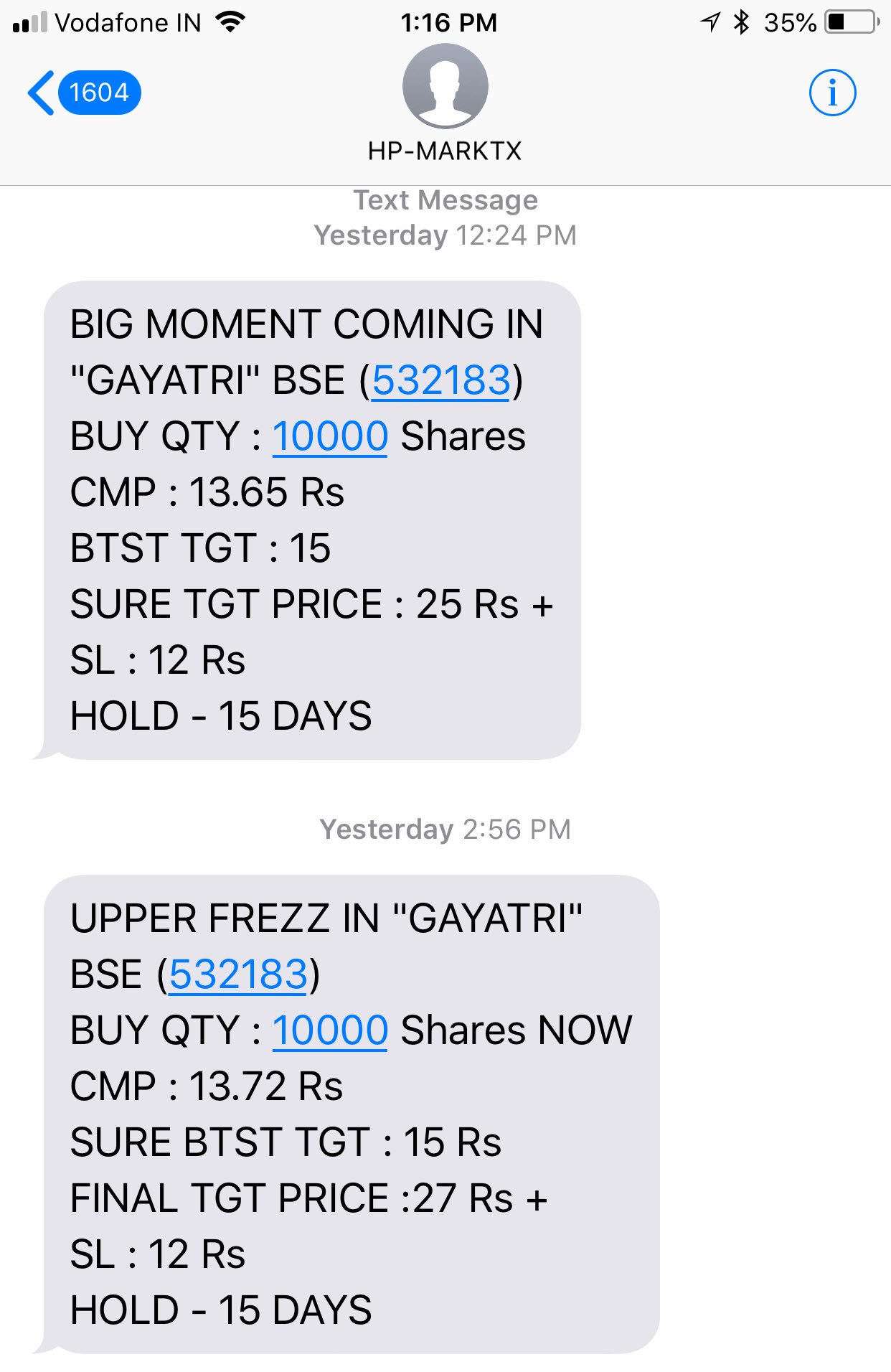

In the past 5 years, SMS pump and dump scams have also become particularly widespread and some of these probably originate from Indore as well. Stock tips like these are sent in bulk to lakhs of people and sometimes these tips even use legitimate names like CNBC, ICICI, etc to trick people.

Typically, operators pick a small low volume stock, which they already own. Most often than not, these stocks are listed on BSE. They start sending out SMS to pump up the prices, and the prices do go up. Once the price goes up, they dump the stock, leaving unwitting investors with worthless stocks. These stocks start hitting upper circuits on their way up and consecutive lower circuits on their way down, leaving no chance of an exit. I had written about this a while ago

Option trading monkeys

There are wonderful little corners on Twitter, Facebook, WhatsApp and Telegram. These are magical places where all MTM screenshots are green, the future is certain, and losses are unknown. These are the most brilliant of brilliant traders from around the country. Sounds like a fairy tale, doesn’t it?

But it’s just that, a tale!

The people who traffic these corners are a particularly insidious bunch. What they do is quite simple really – sell greed! Here’s how a typical scam goes.

Step1: Setup a Twitter account and start posting trades – preferably in Nifty and Bank Nifty. Because leverage equals magnified gains. Slowly you will start attracting dumbass followers. It’s important that you post screenshots of only your profitable trades and not loss-making trades.

Step 2: Give free advice to some gullible traders for a while. Sound like the Mother Teresa of options traders and their personal lord and saviour.

Step 3: If you, by this time, garner enough attention to appear on ET Now, CNBC, etc, then all the better.

Step 4: Start seminars charging lakhs of rupees promising your volatility acceleration, diamond masterclass, Quantum underwear Vix upside capture strategy or some ridiculously stupid name and let the scamming begin!

Quite simple, isn’t it!

If you look around, you’ll see morons like these:

Selling greed, trapping gullible traders

Ask around, and you will hear stories of people who lost their life savings by subscribing to these courses and trading tips. The allure of futures and options is leverage. With a small upfront margin, you trade 5-10X the contract value. If you trade with some smaller brokers, you can get up to 60X – 70X leverage. It looks like is SEBI is clamping down on the margins provided by brokers, and this may all soon go away!

So these option monkeys lure in newbies with promises of quick riches, and predictably this ends in disaster. You will see these idiots on twitter posting screenshots of their supposedly successful trades to lure in the bakras. But at the end of the day, greed sells. No amount of investor education will ever change this.

When Jokers looks like geniuses

Another problem is the complicity of Indian financial media in giving these idiots credibility. On any given day, these tipsters and scamsters can be found on CNBC, ET Now, and other channels glibly pontificating on things they don’t have a clue about. They also dole out trade ideas with Rs 1-2 targets and 50 paise stop-losses. And as is the proud tradition, our retail junta follows these idiots like lambs to slaughter.

Appearing on TV used to mean something. Today, as long as you are a loud idiot on Twitter, chances are, you’ll be invited on TV to talk about some useless event topic – “what does Mr XYZ’s choice of underwear mean for the Nifty?”

And more these idiots appear on TV, the more trading and option selling courses they can sell and defraud more people. And the so continues the gratuitous cycle of ripping of gullible retail traders and investors.

And most often than not, these are guys are worse than an average retail trader. Here’s the prediction record of a popular trainer and analyst who was a popular fixture on business channels. I don’t know jack about options, and I could’ve done a better job.

Brokers

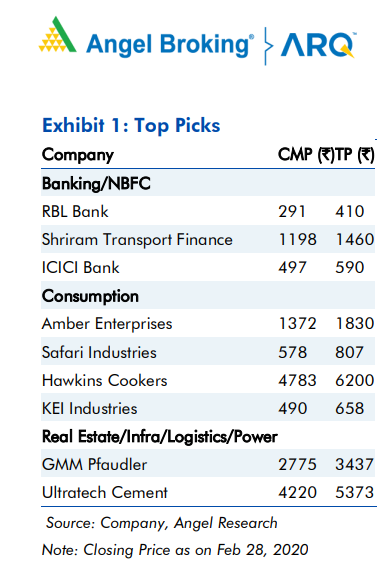

The job of a broker is to provide an execution platform. But they realized that traders and investors left alone wouldn’t trade or invest enough for them to generate brokerage. So, they figured they dress up some bullshit as research to induce people to trade more. And my god, these brokers on any given day generate tonnes of trash in the name of research. Go to any brokers or stock market relates sites, and you will see eye-popping numbers like this:

Who wouldn’t like 15-60% in 6 months? But what people don’t realize is that all these research reports and trading tips are designed purely to induce churn and generate brokerage. Hell, most brokerages don’t even have analysts to prepare these reports. There are companies that provide white-labelled reports where the broker just modifies it a little, slaps his logo, and publishes it.

Anoop Vijaykumar (The Calm Investor) actually kept track of recommendations by brokers in 2018. Here’s how they fared:

Of 118 stocks (with some overlap) recommended by 16 financial institutions as “stock recommendations for 2018”, 92 recommendations (78%) are down for the year. An equal-weighted portfolio holding these 118 stocks would be down 17% for the year.

That’s pathetic! A portfolio picked by monkey’s throwing darts at stock quotes page of the ET would have been more successful, I guess. Not just useless research, brokers are notorious for trading in clients account without consent to generate brokerage. The day, brokers will be banned from giving advice, all of these chindi chor brokers in India will shut down in droves.

Not just stocks, these guys will sell anything that fetches them a commission. Stocks, bonds, mutual funds, AIFs, PMS, structured products, you name it, and they’ll sell it.

Speaking of brokers, this scene from The Wolf Of Wallstreet seems perfect

LIC uncles and private insurance agents

As I was trying to write about this, I didn’t even know how to phrase it. Insurance has to be the biggest scam when it comes to financial services. Any LIC policy that starts with “Jeevan” is most often than not a scam. I don’t think there has ever been a product that is as mis-sold as an insurance policy. Some of these insurance policies have high upfront commissions as high as 50-60% of the first premium, not to mention trail commissions as high as 7.5% throughout the life of the policy.

These products are opaque, complex, and full of hidden charges. You have to admire the ingenuity of insurance agents when it comes to mis-selling these products. There have been countless instances where these agents just made up numbers to sell products. In certain cases, they had made up numbers to show guaranteed returns as high as 25%+, I kid you not! Ironically, people with decades of experience in insurance companies have also fallen for these sales pitches.

3,72,550 books can be written on all the various scams in insurance, and there’s no point in me elaborating this. If you want to know more, just search for “mis-selling” on Moneylife, and you’ll find an ocean of articles.

And the way these agents mis-sell deserves an award. Check out this thread, and you’ll be amazed.

To call some of these claims as blatant lies would be an insult to the word lie. Just one tweet from the thread to highlight this.

Binary trading platforms

This doesn’t get a lot of attention, but I think a decent chunk of people gamble on these platforms. Without a doubt, you’d have come across ads like this from companies like Iqoption, Olymp Trade etc. These platforms offer a product called “Binary Options.” These are basically Yes or No trades. If you get the direction of a trade right, you make money, if not you lose.

These platforms run a ridiculous number of ads, because, the churn in willing suckers is high and they need to find more suckers. The thing about these platforms is that they are designed to suck you in and not let you out. Even if you make money, there will be asinine restrictions. ET Prime had published a really nice article on these platforms. These platforms sell greed brilliantly, but people don’t realize that trading in these products is actually illegal. But the quick lure of money always sucks in suckers.

I am still not done, stay with me! There’s more to this story!

Mis-selling, mis-buying or a bit of both?

Another thing we’ll have to talk about when we are on the topic of advice is mis-selling and mis-buying. And yes, they are different.

Mis-buying is when you deliberately don’t make an effort to learn about a financial product or analyse it. Mis-selling happens when the seller withholds material information or just makes up facts about a product.

Now, let’s grapple with complicated questions. Who’s to blame? Mis-buying is straightforward. If a buyer doesn’t make a reasonable effort to make a good purchase, nothing can save him. But wait, doesn’t the seller have some responsibility to make an honest sale? I don’t know and the answer will vary depending on whom you ask. But things get a little muddled when it comes to mis-selling. Who’s responsible for mis-selling, the buyer, or the seller?

Easy answer: The most common saying used in this context is “caveat emptor” or buyer beware, meaning the buyer of a product is solely responsible. Seems fair, doesn’t it? If you are buying a financial product, you alone are responsible for making the right purchase, no matter the circumstances.

Complicated answer: I think this principle would work if we lived in a world where everybody had the same access to information and if everybody had the same ability to process the information. Financial products are complex, and in a country like India, literacy rates aren’t too high. Moreover, financial literacy isn’t a part of our educational curriculum. We learn of some battle in 1885, which largely serves no real purpose in real life, but we aren’t taught what a term insurance policy is.

Easy answer: Then, financial literacy should be a part of the school curriculum.

Complicated answer: John Lynch is one of the biggest names studying the effectiveness of financial education. His research found that financial education had little to no impact on people’s behavior, and it’s worse among low-income people. Another important finding was that time gap between learning and applying the learning matters. Longer the gap, less useful the education.

We also realized that the length of time between the intervention and the moment the person put it to use was important: Education is more effective when there’s less time between the intervention and the action. Even a lengthy education session has very little effect on a participant’s actions two years later

One interesting solution they proposed thing they proposed is “Just in time education”. Providing financial education, when needed, is more impactful. For example, during the purchase of a product.

On the flipside, Professor Annamaria Lusardi’s research shows that financial literacy does work.

Of-course, in all mis-selling, the responsibility lies with both the buyer and seller. But dismissing mis-selling as oh, the buyer should’ve used brains isn’t right in my view. In tier 3 and lower cities, people aren’t the most literate, and banks and insurance agents are most often than not the most accessible conduits to financial services, and by now we know how they sell.

And moreover, everything is varying degrees of mis-selling. Financial products cannot be sold cleanly, it’s IMPOSSIBLE, it doesn’t matter if it’s an RIA, MF distributor or even god for that matter! If an advisor (RIA) is taking on a client, he promises his best to reasonably help the client to achieve his goals.

Now let’s break it down with an example. When an advisor (RIA), the most honest of the lot among financial intermediates talks to an investor, he helps them set expectations. One of the common things they do is to help clients set a returns expectation when clients ask how much can they get by investing in, for example, equities. Unless an advisor says, he doesn’t know, everything else is mis-selling. Because the answer is no one knows. Even if the advisor says, I don’t know, but Indian equities have historically delivered 12% CAGR, but you can expect 10%, it’s mis-selling. Because that 10-12% is a big number and who knows, India might just become Japan tomorrow. Aan moreover, clients will anchor to that returns expectation, and this tends to act up during market crashes. But this mis-selling is largely benign.

It is not easy for a customer to know which product best suits his needs. What the agent feeds you has to be decoded and this is where a financial planner comes in. He can help interpret the jargon hurled at you by salesmen and enable you to choose the right option. It is important that the buyer learns that he needs a financial planner.

P.V. Subramanyam, Busness Today

Fooled by AIFs

Here’s a real-life example and this blew up a little on twitter. This fellow claims that he was mis-sold into investing in an Alternative Investment Fund (AIF). These products are not for everybody, and the minimum investment is Rs 1 crore.

He claims that even though he didn’t have enough money, the Edelweiss sales guys told him they’d provide 50% as loan and he has to invest the remaining Rs 50 lakhs. This was a close ended fund, meaning you couldn’t exit the fund before the lock-in expired. In the tweets, you can see that he is blaming Edelweiss. But how dumb do you have to be to take a Rs 50 lakh loan to invest in an AIF? At the same time, there’s no doubt the Edelweiss guys would have used every trick in the book to push the product. An AIF isn’t like a mutual fund and people invest in it because they promise big returns. So this person was lured by greed, without a doubt. After making a lot of noise and some big people jumping on the conversation, the person got his money back but how many other victims of mis-selling are that lucky?

This goes to show that things aren’t always black and white. There’s always some mix of mis-buying and mis-selling in every financial product sale.

Bonds, not James Bond but Yes Bank bonds but now no bonds

Let’s take a look at another recent example which illustrates this dichotomy even better. Banks issue Additional Tier 1 bonds to raise capital. If a bank gets into trouble, these bonds are either converted to equity or written off. In the case of Yes Bank, Rs 5400 crores worth of AT1 bonds were written off. Now, judging by the complaints on Twitter, it seems like these bonds were heavily mis-sold by Yes Bank employees and people like this guy below have bought it. These bonds also seem to have been mis-sold as replacements for FDs.

On the face of it, it looks like mis-selling doesn’t it? But then let’s consider the fact that these bonds were yielding 9-10% when FDs were averaging 6-7%. Now, it becomes a little fuzzy.

This fellow seems to be one unfortunate soul, he has also invested in DHFL bonds on top it. Would it reasonable to expect this person to have thought this through. If an FD is yielding lower rates, why is the bank bond yielding higher? But that would assume that he has some understanding of fixed income, what if he is illiterate, would it still be mis-buying?

These things are always fuzzy, and the truth always lies somewhere in the middle.

What’s good financial advice worth?

Now, we have an idea of the various intermediaries, the kind of selling that happens and also the roles and the responsibilities of the buyer and seller. Now let’s grapple with another tricky question – what’s good financial advice worth?

Before that, who’s a good financial advisor?

I’m usually not one for cliched sayings, but these remarks by Josh Brown of Ritholtz Wealth at the opening of Wealthstack, a financial conference for advisors kinda stuck with me.

A good advisor is both coach and quarterback on-demand psychologist and reliable friend, historian, and futurist. We are simultaneously the person in our clients’ lives who gives them permission to enjoy the of their labour and the stern discipline they sometimes need when the fear or greed of the moment begins to take hold. We have to remain detached and businesslike when it comes to their money but personally invested and emotionally supportive when it comes to the challenges and triumphs of their lives. It’s a tricky thing playing all of these roles in our clients’ lives. But it’s this combination of skills training and instinct that makes the value proposition of a true and capable fiduciary advisor incalculable literally priceless.

Josh Brown

And here, when I say advisor, I am talking about someone who is a qualified SEBI registered investment advisor and not the people calling themselves an advisor. There are 1000s of “so-called advisors” who recommend some random mutual funds and charge 1% of the AUM.

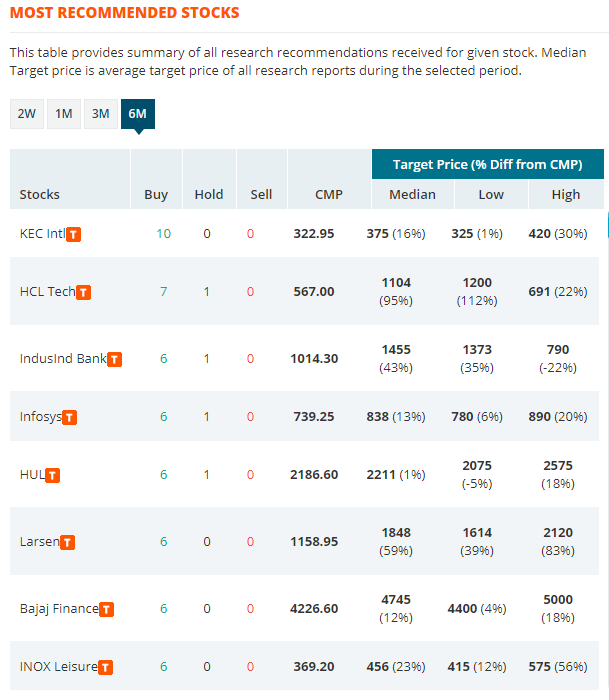

So, what’s the value of a good advisor?

It’s hard to quantify the value of an advisor given that there’s a lot of subjectivity to the benefits that an advisor provides. But reasonable estimations can be made. Vanguard publishes a study called the Advisor’s Alpha which attempts to do this. They outline an advisory framework, which if implemented, adds 3% additional returns.

Morningstar’s Gamma study looked at the value of financial advice in retirement planning and found this:

Morningstar’s Gamma research demonstrates that making sound financial planning decisions in five areas—asset allocation, withdrawal strategy, guaranteed income products, tax-efficient allocation, and portfolio optimization— can generate 29% more income on average for a retiree.

I think of of the biggest benefits that an advisor is simply stopping the client from doing dumb things. For example, just stopping a client from selling in panic during a market crash like the one we are going through can add up significantly in the long run. If anything, if the advisor allocates more to equities by rebalancing from bonds during the crash, as per a pre-defined plan, he can add even more in returns. But all this is hard to quantify, but the fact that advisors can add significant value is undeniable.

Where are the advisors?

Now, let’s wrap this up. We’ve looked at how products are sold, the dumb things investors do and looked at the value of a good financial advisor. Now, let’s look at the number of financial advisors in India.

There are 1292 SEBI RIA registrations. But a vast majority of these aren’t active, and of the ones that are active, a good chunk of them are stock tipsters. It’s kinda ironic that you have to be fiduciary to provide stock and F&O tips, where you know for a fact that the odds of a client losing money are infinitely higher than them making money. And there are serious rotten apples among these RIA stock tipsters. Here are some recent scams:

The number of RIAs providing actual financial advice – both fee-based and fee-only is probably under 200. Yep, that’s how shallow the advisory ecosystem is. To put that into context, there are 2 crore mutual unique mutual fund advisors in India. If all these investors were to hire an honest advisor, we’ll, they wouldn’t be able to.

Distributors

According to Cafemutual, there 1 lakh individual ARN holders and about 1.13 lakh employees employed by distributors. While the number may seem high, the number of distributors actually making enough money is a tiny portion of this. Most of the commissions accrue to the big banks and national distributors. AMFI publishes an annual list of commissions earned by distributors. Of the 1037 distributors, the top 20 distributors earned Rs 4794.57 crores while the rest combined earned Rs 3143.65 crores.

And post the rationalization of expense ratios by SEBI, distributor earnings have dropped. And now that we seem to be heading into a bear market, they will only drop further. It remains questionable as to how many individual distributors are actively building their businesses.

Insurance agents

LIC had 1206702 lakh, individual agents, while all the 23 private life insures combined had 1061714 agents as of February 2020 according to the Life Insurance Council data. No wonder LIC products are the most mis-sold products in India. People might not have heard of mutual funds, but they sure as hell would have probably been mis-sold into LIC policies.

In 2018-19, 27774.54 crores were paid out as commissions out of which Rs 19345.32 crores was from LIC and 8429.23 crores was from private insures. Comparatively, Rs 7938.25 crores was the total mutual fund commission in 2018-19.

Life of an advisor

Being an investment advisor isn’t easy in India (RIA). Recently SEBI increased the educational qualifications and networth requirement for individual and non-individual investment advisors. The exact numbers are yet to be disclosed but a networth require of Rs 10 lakh, up from Rs 1 lakh for individual advisors, and Rs 50 lakh, up from Rs 25 lakh was proposed in the discussion paper. I highly recommend reading this piece by Sandeep Parekh, in which, he takes apart the absurdity of the proposed regulation. But anyway, apart from this, an Indian RIA cannot trade or invest on behalf of a client. Fee collection for RIAs is also a nightmare as they have to collect it through fund transfers, UPI etc which is intent-based and not fully automated. This put RIAs in a disadvantage vs a mutual fund distributor who can sell mutual funds with less oversight and fewer restrictions.

Think about it, a distributor can sell a couple of mutual funds and earn commissions for as long as the investor remains invested. Fee collection is also not an issue because expenses are deducted seamlessly and paid back to the distributor and most regular mutual fund investors till think that they are free.

In the recent decade, the independent RIA movement in the US has grown leaps and bounds. Some estimates say that RIAs manage over $6 trillion in assets, this is because RIAs can execute investments on behalf of clients, collect fees seamlessly and have access to an insane array of tools and products that help them deliver incredible value to clients.

Prashanth in this thread pieces this together beautifully.

So, saying go talk to a financial advisor is easy, but there’s a serious shortage of fiduciary financial advisors in this country. As I was writing this post, this little gem of a tweet surfaced on my timeline. The tweet I’ve quoted is by a financial advisor but if I am right, he is a distributor and he can no longer call himself an advisor. He’s always been anti-direct mutual fund plans and most of his arguments can be summarized as “when you are sick you don’t self-medicate but go to the doctor.” As preposterous as that argument is, I don’t want to get into it.

But I wanted to highlight the quality of the “so-called advisors” in this country.

We also publish Indexheads – a newsletter on all things low-cost passive investing. A lot of people like it, you may too. Check it out 👇

Indexheads India Newsletter

A newsletter on indexing and sensible investing.

Needs to codified as a book.

You Sir are a legend. Take a 1000 bows!!

Well done! I really can’t sympathize with people that bought Yes Bank AT1 “FD like” products. Do your homework. If you don’t have the time, then get FDs from SBI and by happy with that. Even Yes Bank FDs were giving 120 to 150 bps more then other banks…why?

Excellent ! You have opened my eyes. Would like to speak you.

Thanks 🙂 I am @passivefool on Twitter