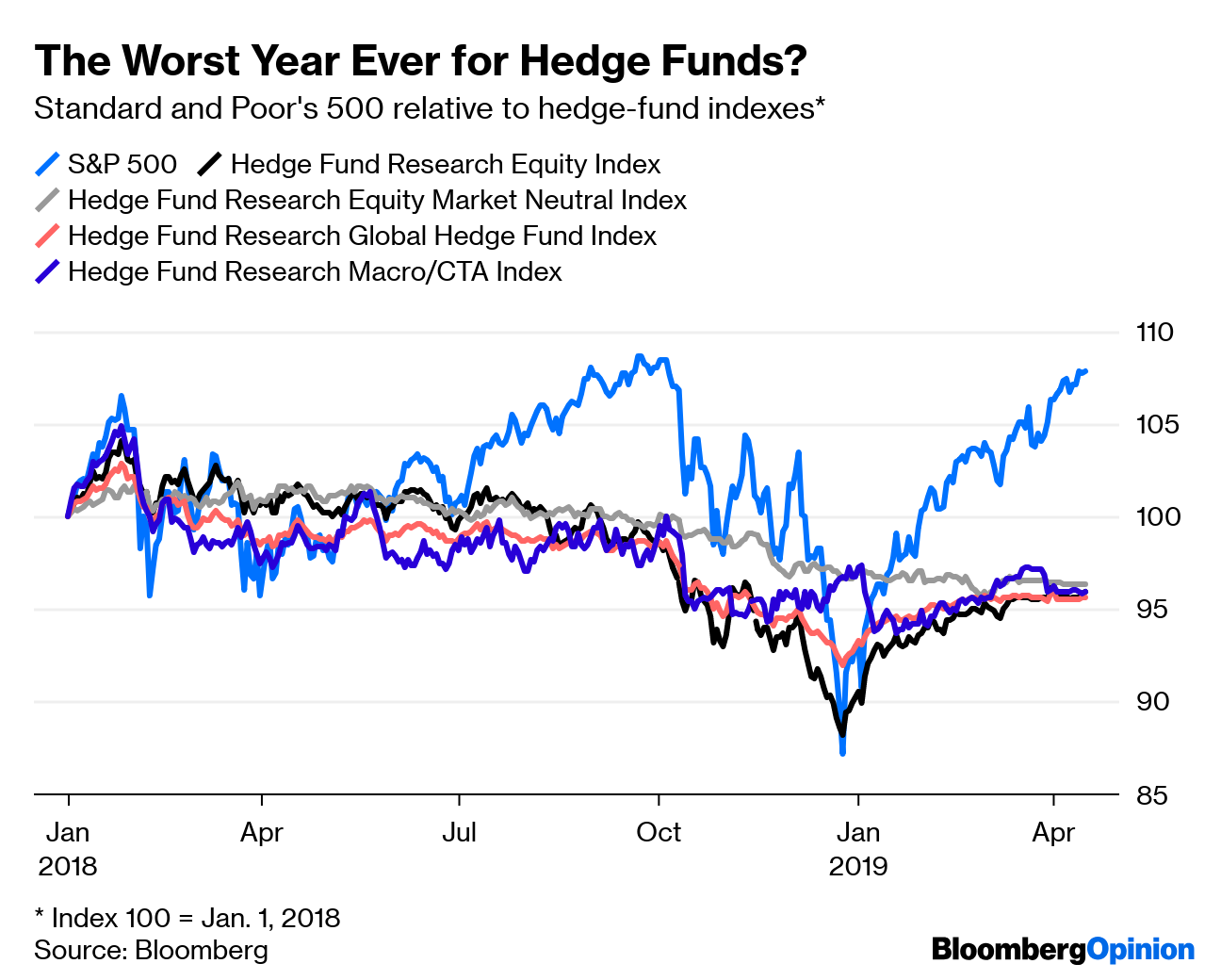

Hedge Funds have this mystical aura around them. Reclusive, eccentric geniuses who can deliver insane returns. But facts are always stranger than fiction. Year to date, the S&P 500 has beaten the popular hedge fund indices.

I’m not writing this post suggesting that hedge funds and endowments should invest in index funds. I’m not that smart and there is plenty of research and literature on the subject.

My takeaway is far more prosaic. If the masters of the universe are having a difficult time outperforming a broad market index, what chance do you think you as a retail investor have? Well, if you are a genius then I have no quarrel with you and you should get the fuck off this blog 😉

All I am asking you to do is to open your mutual fund app and start looking at the performance of your active funds carefully. I promise you, there’s a surprise waiting for you.

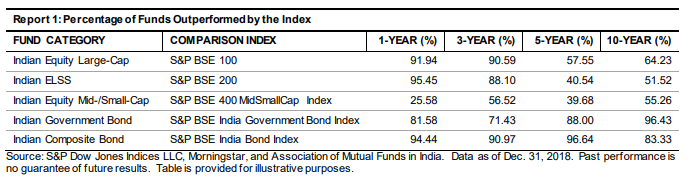

This is a snapshot from the S&P SPIVA report showing the percentage of funds that managed to beat the indices. In recent years, we are seeing that very few actively managed funds have managed to beat their benchmarks.

As a retail investor, your chances of picking stocks and active managers who can beat the markets consistently over the long run is a coin toss. Here’s more data to prove that:

What should you do?

Buy index funds and be happy. Having said that, this isn’t an investment advice blog. Go talk your Registered Investment advisor (RIA). Not your dad’s friend, not your distributor, and most certainly not your LIC uncle. But an actual fee-only RIA and talk to him about index funds, look at the evidence and make the smart choice.